722025 Range Road 52 Rural Grande Prairie No. 1 County Of, AB T8X 0T1

UPDATED:

08/09/2024 07:10 PM

Key Details

Property Type Vacant Land

Sub Type Commercial Land

Listing Status Active

Purchase Type For Sale

Subdivision Hawker Industrial Park

MLS® Listing ID A2103929

Originating Board Grande Prairie

Annual Tax Amount $7

Tax Year 2023

Lot Size 5.040 Acres

Acres 5.04

Property Description

Location

Province AB

County Grande Prairie No. 1, County Of

Zoning RM-2

Exterior

Fence Partial

Others

Restrictions None Known

Tax ID 85013450

Ownership Other

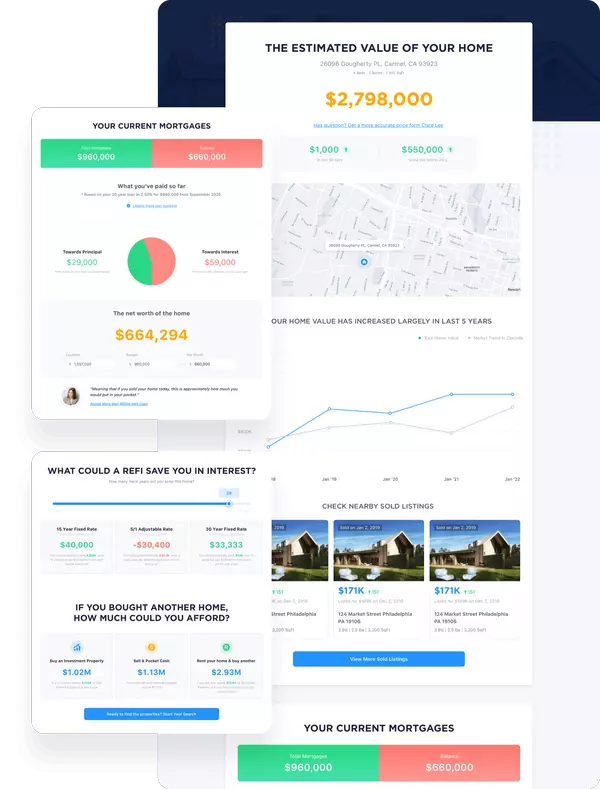

MORTGAGE CALCULATOR

By registering you agree to our Terms of Service & Privacy Policy. Consent is not a condition of buying a property, goods, or services.

Go tour this home

722025 Range Road 52

- Any

- $ 100,000

- $ 150,000

- $ 200,000

- $ 400,000

- $ 800,000

- Any

- $ 100,000

- $ 150,000

- $ 200,000

- $ 400,000

- $ 800,000

MARKET SNAPSHOT

(NOV 12, 2024 - DEC 12, 2024)

MARKET SNAPSHOT

By registering you agree to our Terms of Service & Privacy Policy. Consent is not a condition of buying a property, goods, or services.

Why Choose Us

Free & Instant Home Valuation

Estimate how much you can get by selling your home and keep track as the market changes.

Sell Faster

Our team utilizes the power of online marketing to sell faster than an average real estate agent.

Save Money

Our experts help you sell for the highest price point possible.

MY BLOGS

Interest Rate Announcement: BoC Delivers Second Consecutive “Jumbo” Rate Cut