912 3rd AVE Beaverlodge, AB T0H 0C0

UPDATED:

11/26/2024 06:40 PM

Key Details

Property Type Single Family Home

Sub Type Detached

Listing Status Active

Purchase Type For Sale

Square Footage 1,040 sqft

Price per Sqft $120

MLS® Listing ID A2163071

Style Single Wide Mobile Home

Bedrooms 2

Full Baths 1

Originating Board Grande Prairie

Year Built 1974

Annual Tax Amount $1,011

Tax Year 2024

Lot Size 4,200 Sqft

Acres 0.1

Property Description

doors, R45 insulation in the ceiling, Shingles are 13 years old, Styrofoam insulation and vinyl siding, all wiring and fixtures, plumbing PVC, furnace is 19 years old, new kitchen cabinets and counter tops, laminate and some lino flooring, it comes with 4 appliances, 2 sheds, 1 porch, beautiful deck to catch the best times of the sunshine. The fridge is new, the home is very cozy on the outside, good for the green thumb owner. Call today for your personal viewing before it is gone.

Location

Province AB

County Grande Prairie No. 1, County Of

Zoning R2

Direction W

Rooms

Basement None

Interior

Interior Features Ceiling Fan(s)

Heating Forced Air, Natural Gas

Cooling None

Flooring Laminate, Linoleum

Inclusions 2 Sheds

Appliance Dryer, Electric Stove, Refrigerator, Washer/Dryer

Laundry Main Level

Exterior

Garage Parking Pad

Garage Description Parking Pad

Fence Fenced

Community Features Golf, Park, Pool, Shopping Nearby, Street Lights, Tennis Court(s)

Utilities Available Cable Available, Cable Internet Access, DSL Available, Electricity Connected, Natural Gas Connected, Fiber Optics Available, Garbage Collection, Phone Available, Sewer Connected, Water Connected

Roof Type Asphalt Shingle

Porch Deck, Porch

Lot Frontage 35.0

Total Parking Spaces 2

Building

Lot Description Back Lane, Back Yard, City Lot, Landscaped

Foundation Piling(s), Poured Concrete

Sewer Sewer

Water Public

Architectural Style Single Wide Mobile Home

Level or Stories One

Structure Type Vinyl Siding

Others

Restrictions None Known

Tax ID 94265955

Ownership Private

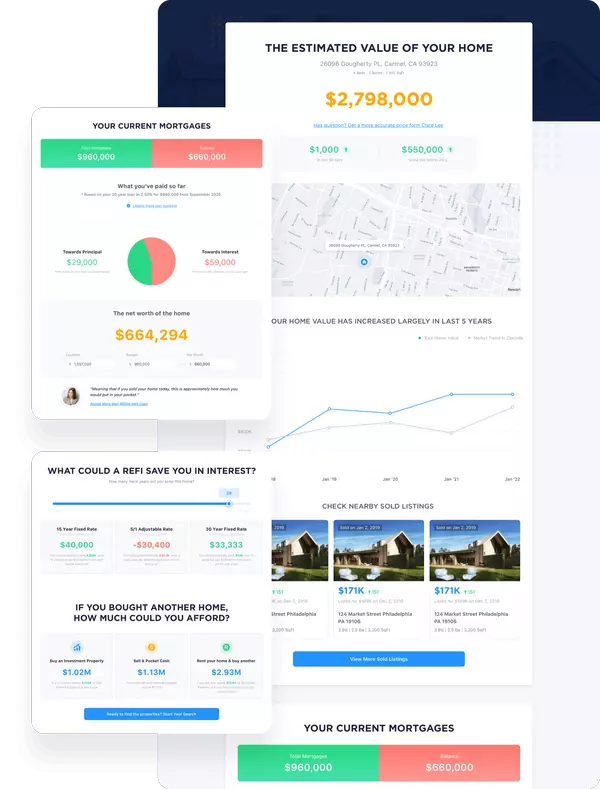

MORTGAGE CALCULATOR

By registering you agree to our Terms of Service & Privacy Policy. Consent is not a condition of buying a property, goods, or services.

Go tour this home

912 3rd AVE

- Any

- $ 100,000

- $ 150,000

- $ 200,000

- $ 400,000

- $ 800,000

- Any

- $ 100,000

- $ 150,000

- $ 200,000

- $ 400,000

- $ 800,000

MARKET SNAPSHOT

(OCT 28, 2024 - NOV 27, 2024)

MARKET SNAPSHOT

By registering you agree to our Terms of Service & Privacy Policy. Consent is not a condition of buying a property, goods, or services.

Why Choose Us

Free & Instant Home Valuation

Estimate how much you can get by selling your home and keep track as the market changes.

Sell Faster

Our team utilizes the power of online marketing to sell faster than an average real estate agent.

Save Money

Our experts help you sell for the highest price point possible.

MY BLOGS

Kenora Housing Market Outlook (2025)

The average sale price in the Kenora housing market has increased by 2.1 per cent across all property types between 2023 and 2024, from $318,688 to $325,271. The number of sales transactions increased by 1.8 per cent for the same time period, rising from 2,030 sales in 2023 to 2,067 sales in 2024. Meanwhile, the total number of listings increased by 2.5 per cent this year, from 2,871 in 2023 to 2,944 in 2024. Looking ahead to 2025, the Kenora housing market is expected to favour sellers. Average price is anticipated to rise by 2.5 per cent, while the number of sales will also likely increase by 2.5 per cent. Total listings in 2025 are expected to increase by 2.5 per cent, with the number of new listings hitting the market expected to increase by three per cent.Find a RE/MAX AgentDemand in the region will be driven primarily by first-time buyers, but also interest from move-up buyers, retirees and downsizers, investors and distressed sales (those forced to sell due to rising costs). Single-detached houses are expected to see the most sales activity in the region in 2025.First-time homebuyers are buying single-detached homes and small bungalows in the $300,000 price range, while move-up and move-over buyers are purchasing larger detached homes in the $450,000 to $550,000 price range. Meanwhile, retirees are buying and driving demand for condominiums around the $500,000 price point.New developments are not proceeding as planned in Kenora due to the high cost of building. Home sellers are feeling more confident due to a lack of new construction in the region. Looking ahead to 2025, sales are expected to stay strong.Buyer confidence is expected to be high in Kenora in 2025 compared to 2024, with lower interest rates and amortization structures making it easier for first-time homebuyers to enter the market. As interest rates continue to decrease, more first-time homebuyers are expected to enter the market.Read the Full ReportThe post Kenora Housing Market Outlook (2025) appeared first on RE/MAX Canada.

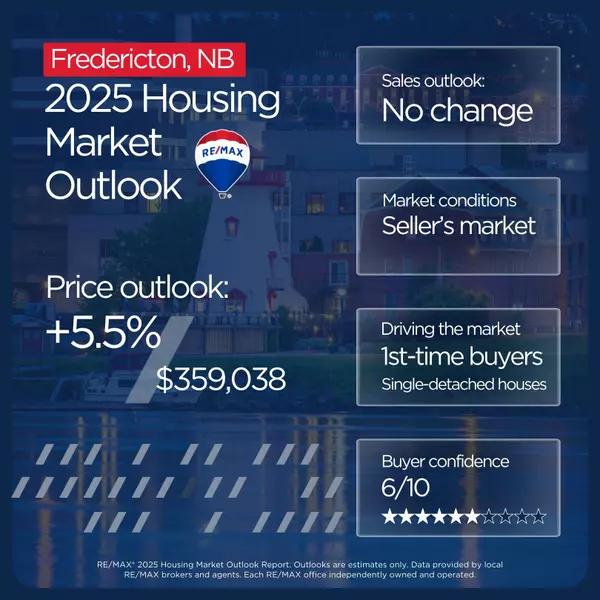

Fredericton Housing Market Outlook (2025)

The average residential sale price in Fredericton/Oromocto housing market has increased by 6.2 per cent across all property types between 2023 and 2024 from $320,378 to $340,320. The number of sales transactions increased by 4.25 per cent for the same period (from 1,954 to 2,037). The total number of listings increased by 8.5per cent (from 2,668 in 2023 to 2,896 in 2024). The number of new listings also increased by 8.5 per cent (from 2,668 in 2023 to 2,896 in 2024). Looking ahead to 2025, Fredericton/Oromocto is expected to transition to a seller’s market. In 2025, average prices across all property types are anticipated to increase by 5.5 per cent, while the number of sales is expected to remain flat. Total listings are expected to decrease due to ongoing uncertainty in the market. Find a RE/MAX AgentFirst-time buyers, retirees, investors and buyers of distressed sales (those forced to sell due to rising costs) are expected to drive market activity in 2025, with single-detached houses accounting for the bulk of sales activity in the region. First-time homebuyers are typically purchasing smaller condominiums, semi-detached houses and older detached houses within the $300,000 price point. Move-up buyers are in the market for single-detached homes that offer adequate space for growing families in the $375,000 – $450,000 price range. Retirees are looking to downsize, buying small one-level homes, condos, townhomes, mini-homes priced from $250,000 – $300,000. For new construction activity in the region, garages will be important, along with building in family-friendly areas and close proximity to schools. Heading into 2025, home sellers feel that their homes should yield big increases, due to post-pandemic activity from 2021 to 2023. Lower interest rates will benefit buyers as this will help make homes more affordable. In addition to lower interest rates, 30-year amortization on new construction will make it easier for first-time homebuyers to purchase a home in the region. Read the Full ReportARCHIVEFredericton Housing Market Outlook (Fall 2024 Update)The average sale price in the Fredericton housing market has increased by 5.6 per cent year-over-year across all property types, between January 1 and July 31, 2024 (from $324,351 in 2023 to $342,633 in 2024). The number of sales increased by 3.1 per cent duringor the same time period (from 1,373 home sales in 2023 to 1,415 sales in 2024). The number of listings also increased by 7.8 per cent (from 1,893 in 2023 to 2,041 in 2024). Looking ahead to teh fall market, the average sale price across all property types in the Fredericton housing market is anticipated to increase by two per cent through the remainder of 2024, while the number of sales is expected to increase by roughly 1.5 per cent.The Fredericton housing market is currently a seller’s market, which is anticipated to continue into the fall. The shorter the supply, the more people looking to buy the same home, which puts upward pressure on prices.The biggest factors contributing to the housing shortage in Fredericton include:• Not enough new listings• Not enough new construction• Construction delays as a result of labour shortages and increased material costs• Exclusionary zoning/land availabilityOn September 4, the Bank of Canada will share its next interest rate announcement. If two more interest rate cuts are announced by the Bank, this will help increase mortgage approval amounts so people can better afford to buy homes. However, further rate cuts could also increase multiple-offer scenarios, which will in turn raise home prices. Buyers are paying more than they should be paying, due to immense competition on new listings. The trend of lower interest rates in 2024 is driving up prices, making it hard for a buyer to get a home due to more competition.Fredericton Housing Market Outlook (2024)Fredericton Housing Market Outlook (2023)Fredericton Housing Market Outlook (2021)Fredericton housing market to favour sellers in 2021, prices expected to rise 3-4%The Fredericton housing market is expected to sit in seller’s market territory in 2021 due to a lack of inventory, which has been a common trend across many Canadian housing markets, which have prices trend upward in 2020. Indeed, the average selling price of detached homes in Fredericton increased to $211,023 in 2020 (Jan. 1 – Oct. 31), up from $196,606 in 2019 (Jan. 1 – Dec. 31). Meanwhile, the average price of condominiums in the region reached $168,478 in 2020 (Jan. 1 – Oct. 31) down from $172,412 in 2019 (Jan. 1 – Dec. 31). However, condo prices are expected to pull ahead once 2020 full-year data has been reported. With housing supply expected to be a continuing challenge next year, the RE/MAX outlook for Fredericton residential real estate in 2021 is an increase in average price of 3 to 4%, to approximately $196,391 across all property types.With that said, COVID-19 is expected to have an impact on activity and supply levels. The number of home sales in the region is expected to increase 5% in 2021, pending stabilization of infection rates and a possible vaccine, prompting more people to list their homes for sale, adding a much-needed boost to supply levels. If this indeed transpires, the market may shift toward more balanced territory. Inventory levels are expected to stay at around two to three months in 2021.Download the infographic.Who’s driving the Fredericton housing market?COVID-19 has prompted a shift in consumer demand, toward larger properties and homes with more square footage.As is common under seller’s market conditions, Fredericton homebuyers have been more willing to compromise in order to secure a home.Out-of-town buyers have been the main market driver in 2020, with condominium properties and detached homes experiencing the greatest demand, with 2020 year-to-date home sales (Jan. 1 – Oct. 31) in each of these categories just shy of full-year sales in 2019. However, all property types have been moving quickly in 2020, including “tiny homes.”First-time homebuyers in Fredericton are typically young couples seeking single-detached homes in the range of $170,000 to $210,000. First-time buyers experienced some challenges getting into the market in 2020, including low inventory, rising prices and the overarching impacts of COVID-19. Move-up buyers in Fredericton, who are typically families, have also been challenged by low inventory and inflated prices. However, some relief could be in store, with interest rates expected to sit at historic lows, and more supply expected to come on stream in 2021.The local condo market is being primarily driven by single homebuyers and young couples. As is the case across all property types, there is currently a shortage of condo properties for sale.Fredericton’s hottest neighbourhoodsFredericton’s top-selling neighbourhoods in 2020 were Killarney (Liberty and Lakeside Estates), Brookside West (North Side) and Downtown, based on the number of transactions. In 2021, a slight shift is expected, with high demand for Killarney, Downtown and the Hill Area. This is being attributed to high demand for single family homes, which are common in the downtown core and close to the university.Fredericton new-home constructionNew construction is being added to Fredericton’s “stretched” housing supply. New homes are increasing in price, due to the higher cost of construction materials and the shortage of homes putting pressure on prices. New construction is expected to continue adding much-needed supply in the area, however the rate of new construction is still too low to meet current demand.Canadian housing market in 2021Canadians are on the move. RE/MAX isn’t calling this an “exodus,” but the re-location trend across the Canadian housing market is real, and it’s just one focus of the RE/MAX 2021 Housing Market Outlook Report. RE/MAX Canada anticipates healthy housing price growth at the national level, with move-up and move-over buyers continuing to drive activity in many regions across the Canadian housing market. An ongoing and widespread housing supply shortage is likely to continue, presenting challenges for homebuyers and putting upward pressure on prices.Due to these factors, the 2021 RE/MAX 2021 outlook for average residential prices is an estimate of +4% to +6% nation-wide. Here’s the regional break-down:Click to download the data table.Additional report findings include:35% of RE/MAX brokers indicate that “move-over” buyers from other cities and provinces will continue to spark market activity in 202145% of RE/MAX brokers indicate that move-up buyers will likely be a primary driver of the housing market demand in 2021Half of Canadians (53%) are confident that Canada’s housing markets will remain steady in 202152% of Canadians believe real estate will remain one of the best investment options in 2021“We’ve seen a lot of anecdotal evidence since the summer that households are considering significant lifestyle changes by relocating to less-dense cities and neighbourhoods,” says Christopher Alexander, Executive Vice President and Regional Director, RE/MAX of Ontario-Atlantic Canada. “This has sparked unprecedented sales this year in suburban and rural parts of Canada and we expect this trend to continue in 2021.”Click to read the full report.Fredericton Housing Market Outlook (Fall 2020)The Fredericton housing market saw real estate activity come to a nearly complete halt in mid-March, but “pandemic pause” proved to be short-lived and it wasn’t long before home sales began to pick up again toward the end of April and moving into May, according to the RE/MAX Fall Market Outlook Report.May 2020 home sales in Fredericton surpassed month-over-month and year-over-year levels, illustrating what many predicted would be a delayed start to the traditionally busy spring market. Indeed, the busy month of May continued into June, as sellers began to regain confidence and comfort in hosting showings in their homes, with strict safety protocols still in place.Moving into the fall and based on recent activity, Fredericton home prices are expected to maintain their current value and remain stable. Homebuyers and sellers engaging in the local real estate market have maintained optimism that they will see a return to some sense of normalcy within the next year. In light of recent activity and positive consumer sentiments, RE/MAX anticipates a 2.5% increase in average residential sales in Fredericton, New Brunswick for the remainder of 2020.Atlantic Real Estate Market TrendsAtlantic Canada regions reporting low case counts of COVID-19, such as Halifax, Charlottetown and Saint John saw reduced market activity in March, however the decline was less pronounced than that experienced by some Ontario and Western Canada markets. Halifax, Atlantic Canada’s biggest housing market, continues to experience a shortage in listing inventory that characterized the region before the pandemic. The shortage has prompted an uptick in average residential sale price, with a 10% increase anticipated for the remainder of the year. Activity in Atlantic Canada was back to pre-COVID-19 levels by May 2020, and like many sellers’ markets in Canada, multiple offer scenarios continue to happen in these regions.Atlantic Real Estate Market TrendsRegions across the Atlantic region reporting low case counts of COVID-19, such as Halifax, Charlottetown and Saint John saw reduced market activity in March, however the decline was less pronounced than that experienced by some Ontario and Western Canada markets. Activity in Atlantic Canada was back to pre-COVID-19 levels by May 2020, and like many sellers’ markets in Canada, multiple offer scenarios continue to happen in these regions.DOWNLOAD THE HEAT MAP.Canadian Housing Market TrendsLeading indicators from RE/MAX brokers and agents across Canada’s housing market point to a strong market for the remainder of 2020. According to the RE/MAX Fall Market Outlook Report, RE/MAX brokers suggest that the average residential sale price in Canada could increase by 4.6% during the remainder of the year. This is compared to the 3.7% increase that was predicted in late 2019.DOWNLOAD DATA TABLE.The pandemic has prompted many Canadians to reassess their living situations. According to a survey conducted by Leger on behalf of RE/MAX Canada, 32% of Canadians no longer want to live in large urban centres, and instead would opt for rural or suburban communities. This trend is stronger among Canadians under the age of 55 than those in the 55+ age group. Not only are Canadians more motivated to leave cities, but changes in work and life dynamics have also shifted their needs and wants for their homes. According to the survey, 44% of Canadians would like a home with more space for personal amenities, such as a pool, balcony or a large yard.Canadians equally split on their confidence in the housing marketCanadians are almost equally split in their confidence in Canada’s real estate market, with 39% as confident as they were prior to the pandemic, and 37% slightly less confident. When it comes to the prospect of a second wave of COVID-19, 56% of Canadians who are feeling confident in Canada’s real estate market are still likely to buy or sell. “The classically hot spring market that was pushed to the summer months due to the COVID-19 pandemic created a surprisingly strong market across Canada and across all market segments,” says Christopher Alexander, Executive Vice President and Regional Director, RE/MAX of Ontario-Atlantic Canada. “Looking ahead, government financial aid programs may be coming to an end in September, which could potentially impact future activity; however, the pent-up demand and low inventory dynamic may keep prices steady and bolster activity for the remainder of 2020. Overall, we are very confident in the long-term durability of the market.” Additional highlights from the 2020 RE/MAX Fall Market Outlook Report Survey:48% of Canadians would like to live closer to green spaces48% of Canadians say it’s more important than ever to live in a community close to hospitals and clinics33% of Canadians would like more square footage in their home and have realized they need more space44% of Canadians want a home with more outdoor space and personal amenities (i.e. balcony, pool etc.)About the 2020 RE/MAX Fall Market Outlook Report The 2020 RE/MAX Fall Market Outlook Report includes data and insights supplied by RE/MAX brokerages. RE/MAX brokers and agents are surveyed on market activity and local developments. READ THE FULL REPORT .The post Fredericton Housing Market Outlook (2025) appeared first on RE/MAX Canada.

Simcoe County Housing Market Outlook (2025)

The average sale price in the Simcoe County housing market has decreased by 0.7 per cent across all property types year-over-year, from $810,249 in 2023 to $804,250 in 2024. The number of sales transactions decreased by 29.7 per cent for the same time period, from 2,361 units sold in 2023 to 1,659 sales in 2024. The total number of listings decreased by 10.3 per cent, from 4,613 properties put up for sale in 2023 to 4,140 listings in 2024, and the number of new listings increased by 23.5 per cent (from 1,219 in 2023 to 1,506 in 2024). Looking ahead to 2025, Simcoe County is expected to be a seller’s market. Average prices are anticipated to rise by 10 per cent, while the number of sales will also likely increase by 25 per cent. Total listings and new listings are expected to increase by 20 per cent in 2025.Find a RE/MAX AgentSingle-detached houses are expected to see the most sales activity in the region next year.Move-up buyers are expected to drive market activity in 2025, purchasing detached homes in the $800,000 price range.Buyer confidence is expected to be very high in Simcoe County next year compared to 2024, with reduced fixed mortgage rates and amortization structures making it easier for first-time homebuyers to enter the market.First-time homebuyers are commonly purchasing townhomes at the $600,000 price point, while retirees are buying detached homes at the $900,000 price point.New construction projects are expected to pick up again in 2025 after developments slowed due to high building costs.Read the Full ReportARCHIVEBarrie Housing Market Outlook (Fall 2024 Update)The average sale price in the Barrie housing market has increased by 1.1 per cent year-over-year across all property types, between January 1 and July 31, 2024 (from $759,569 in 2023 to $768,196 in 2024). The number of sales decreased by 39.9 per cent during the same time period (from 2,418 sales in 2023 to 1,454 sales in 2024). The number of listings also decreased by 15.3 per cent (from 4,307 in 2023 to 3,647 in 2024). Looking ahead to the fall market, the average sale price in the Barrie housing market is expected to increase by five per cent, while the number of sales may see a robust boost of roughly 20 per cent. Barrie is currently a seller’s market, conditions that will likely persist into the fall, given the lack of inventory and a steep drop in listings.The biggest factors contributing to the housing shortage in Barrie include:• Not enough new listings• Not enough new construction• Construction delays as a result of labour shortages and increased material costs• Exclusionary zoning/land availabilityAs a result of the housing shortage, move-up buyers in Barrie have been reluctant to list without assurance that they can find a property that fits their criteria, while sellers are holding out for unrealistic prices. Despite government programs and investment into new builds, the pre-construction market is stalled and not likely to address supply concerns in the short-term.On September 4, the Bank of Canada will share its next interest rate announcement. If the Bank of Canada announces another rate cut, the market may see local activity pick up in the fall. As a result of falling interest rates, demand in the region continues to build slowly. Buyers have been active, but the majority have opted to wait on the sidelines and are hesitant to make offers.Barrie Housing Market Outlook (2024)Barrie Housing Market Outlook (2021)Barrie Housing Market Outlook 2021Are house prices in Barrie rising or falling?What factors are driving demand in Barrie’s housing market?How fast are new houses being built in Barrie?Statistical findings from the 2021 Housing Market Outlook ReportSeller’s market expected for Barrie in 2021, prices expected to rise 4%The Barrie housing market is in store for another seller’s market in 2021, thanks to continuing challenges in housing supply, growing demand and rising prices. Low inventory has been a common trend across many Ontario housing markets, putting upward pressure on prices.Average House Prices in BarrieIndeed, single-detached homes in Barrie saw prices rise to an average $596,960 in 2020 (Jan. 1-Oct. 31) compared to $539,890 in 2019 (Jan. 1-Dec. 31). During the same period, the average price of condominium properties in the region increased to $399,408. Low supply and rising prices are expected to be a continuing factor in 2021 market activity. Thus, the RE/MAX outlook for Barrie real estate is an increase of 4% in average price to $569,525 across all property types, with sales also expected to see an increase of 5% over 2020 levels.Housing inventory is very tight in Barrie, currently sitting at one to two months. This shortage that prompted a seller’s market in 2020 is likely to continue in 2021. While more housing supply is expected to come on stream, demand will far outweigh any boost in inventory. Days on market should remain on par with 2020 levels.Download the infographicWho’s driving demand for Barrie real estate?Demand from homebuyers leaving the Greater Toronto Area is expected to remain very high in 2021, putting pressure on housing supply and prompting continued price growth in the region. Move-over buyers have been a longer-term trend in the Barrie area, however COVID-19 has intensified this activity in 2020, with many buyers seeking more space further away from densely populated urban areas. With Barrie being only 45 minutes north of the GTA and offering homes at half the price, Barrie continues to be a hot move-over market.Buyers from the pricey GTA continue to flock to Barrie, which is only 45 minutes north of the GTA and offers homes at half the price.First-time homebuyers are typically young couples, seeking townhomes in the $490,000-$550,000 price range. Low interest rates will keep them in the game along with regional affordability, unless prices rise more than 10 per cent. Multiple offers have been a common occurrence in 2020, which has been a lesson for many first-timers who have had to adjust their offer strategy due to competing offers. This has also been the case for move-up homebuyers in the area, typically families who have faced the same challenges around multiple offers and a shortage of listings. These conditions are expected to continue in 2021 as well.Barrie’s condo market is experiencing similar conditions to its low-rise counterpart, characterized by tight inventory, high demand and rising prices. Condo sales caught up to 2019 levels by the end of October 2020, with continued pressure expected in 2021. Agents with condo listings initially had to rebuild their showing protocols to ensure COVID safety, due to condominiums’ contained environments, however agents and clients alike have made all adjustments necessary to be safe and have been transacting without issue.Luxury real estate in Barrie is being predominantly driven by move-up and recreational home buyers, with an average starting of $800,000. Demand for high-end homes has increased in the Barrie market, which is expected to be a longer-term trend.Barrie new-home constructionAlthough many new starts are planned and developed land has started to come on line new-home builds in Barrie have slowed for a number of reasons. Municipal approvals and subdivision plans/permits have experienced delays, due to the COVID-19 shut-down and low staffing levels. Furthermore, building supplies are scarce and more expensive. Finally, builders were challenged in finding trades due to CERB availability or lack of childcare. However, small renovations and non-custom home improvements have been absolutely booming, along with cottage improvements and winterizations. However, this sector is also impacted by limited choice of materials available, and pools, boats, RV’s all being sold out.Canadian Housing Market in 2021Canadians are on the move. RE/MAX isn’t calling this an “exodus,” but the re-location trend across the Canadian housing market is real, and it’s just one focus of the RE/MAX 2021 Housing Market Outlook Report. RE/MAX Canada anticipates healthy housing price growth at the national level, with move-up and move-over buyers continuing to drive activity in many regions across the Canadian housing market. An ongoing and widespread housing supply shortage is likely to continue, presenting challenges for homebuyers and putting upward pressure on prices.Due to these factors, the 2021 RE/MAX 2021 outlook for average residential prices is an estimate of +4% to +6% nation-wide. Here’s the regional break-down:Click to download the data tableAdditional report findings include:35% of RE/MAX brokers indicate that “move-over” buyers from other cities and provinces will continue to spark market activity in 202145% of RE/MAX brokers indicate that move-up buyers will likely be a primary driver of the housing market demand in 2021Half of Canadians (53%) are confident that Canada’s housing markets will remain steady in 202152% of Canadians believe real estate will remain one of the best investment options in 2021“We’ve seen a lot of anecdotal evidence since the summer that households are considering significant lifestyle changes by relocating to less-dense cities and neighbourhoods,” says Christopher Alexander, Executive Vice President and Regional Director, RE/MAX of Ontario-Atlantic Canada. “This has sparked unprecedented sales this year in suburban and rural parts of Canada and we expect this trend to continue in 2021.”Click to read the full reportBarrie Housing Market Outlook (2020)Balanced market expected in 2020, prices to rise 5%The RE/MAX Barrie Housing Market Outlook for 2020 is calling for balanced market conditions, which characterized market activity in 2019 as well. The average residential sale price expectation for Barrie in 2020 is an increase of five per cent, due to similar market conditions and demand levels experienced in 2019.Housing affordability continues to be the region’s main draw, attracting homebuyers from pricier parts of the Greater Toronto Area. New development projects in land annexed south of Barrie and upcoming condominium projects are expected to have an impact on the housing market ahead. An automotive innovation industrial employment project has also been approved in Oro, which will lead to job creation and a boost is market activity.Additional factors that are expected to have an impact in the local housing market include potential changes in interest rates, additional GO Train service for commuters, demand and inventory levels.Move-up buyers and first-time buyers are expected to drive demand in 2020, which has historically been the case for Barrie’s housing market. Popular neighbourhoods to watch in 2020 include southwest Barrie (Holly and Ardagh), City Centre and the Hanmer Street area.From a national perspective, RE/MAX anticipates a leveling out of the highs and lows that characterized the Canadian housing market in 2019, particularly in Vancouver and Toronto, as we move into 2020. Healthy price increases are expected, with an estimated 3.7-per-cent increase in the average national residential sales price, according to the RE/MAX 2020 Housing Market Outlook Report.Most individual markets surveyed across Canada experienced moderate price increases year-over-year from 2018 to 2019. However, some regions in Ontario continue to experience higher-than-normal gains, including London (+10.7 per cent), Windsor (+11 per cent), Ottawa (+11.7 per cent) and Niagara (+12.9 per cent).“Southern Ontario is witnessing some incredibly strong price appreciation, with many regions seeing double-digit gains,” says Christopher Alexander, Executive Vice President and Regional Director, RE/MAX of Ontario-Atlantic Canada. “Thanks to the region’s resilient economy, staggering population growth and relentless development, the 2020 market looks very optimistic.”DOWNLOAD THE INFOGRAPHIC HEREThe post Simcoe County Housing Market Outlook (2025) appeared first on RE/MAX Canada.

REVIEWS

- I met with the realtor Ahmed Arshad through Houseful online agency. He was very polite gentleman who knows his job and in very professional manner he sold our house in three days for very good price. Later he guided us to buy a new house. And he showed us how to be careful about some missing, or bad things in the houses we looked at. It was a very exciting adventure working with Mr Ahmed Arshad and for very short time we found and bought the house were now we live in. Thankful Kiro and LidijaKiro Seremetkoski

- Definitely will recommend to those who is looking for their new home.Jeric Salazar

- Erica Salazar

Our Team

1301 8th Street SW, Calgary, AB, Canada