4317 43 ST Castor, AB T0C0X0

UPDATED:

08/23/2024 09:45 PM

Key Details

Property Type Vacant Land

Sub Type Residential Land

Listing Status Active

Purchase Type For Sale

MLS® Listing ID A2159313

Originating Board Central Alberta

Annual Tax Amount $600

Tax Year 2024

Lot Size 8,320 Sqft

Acres 0.19

Property Description

Location

Province AB

County Paintearth No. 18, County Of

Zoning R1

Exterior

Fence None

Others

Restrictions None Known

Tax ID 56759217

Ownership Local Government

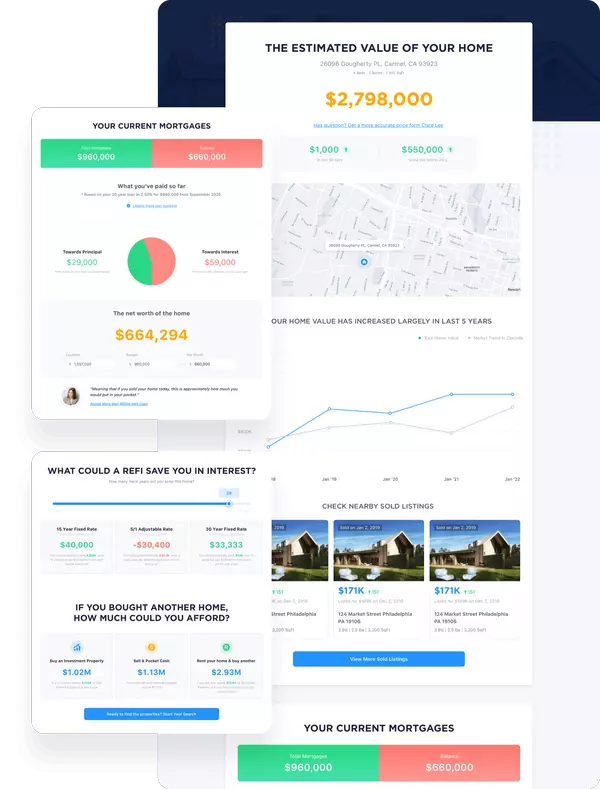

MORTGAGE CALCULATOR

By registering you agree to our Terms of Service & Privacy Policy. Consent is not a condition of buying a property, goods, or services.

Go tour this home

4317 43 ST

- Any

- $ 100,000

- $ 150,000

- $ 200,000

- $ 400,000

- $ 800,000

- Any

- $ 100,000

- $ 150,000

- $ 200,000

- $ 400,000

- $ 800,000

MARKET SNAPSHOT

(NOV 03, 2024 - DEC 03, 2024)

MARKET SNAPSHOT

By registering you agree to our Terms of Service & Privacy Policy. Consent is not a condition of buying a property, goods, or services.

Why Choose Us

Free & Instant Home Valuation

Estimate how much you can get by selling your home and keep track as the market changes.

Sell Faster

Our team utilizes the power of online marketing to sell faster than an average real estate agent.

Save Money

Our experts help you sell for the highest price point possible.

MY BLOGS

What is a VTB?

Getting approved for a mortgage can be tough. Lenders dig into every aspect of your financial life, from your credit history to your job and debt levels. With rising real estate prices in cities like Toronto and Vancouver and higher interest rates, securing a traditional mortgage has become even more challenging. If you’ve recently been through bankruptcy, have no down payment, or have a poor credit history, traditional lenders might reject your application. The Canadian mortgage stress test has also made it more difficult for many potential buyers to qualify for traditional loans, adding another layer of complexity. This can feel overwhelming and discouraging, especially when you’re eager to secure a home.In these situations, a VTB or vendor take back mortgage could be a great alternative. What is a VTB mortgage? This type of mortgage allows you to bypass some of the rigid requirements of traditional lenders. Instead of dealing with a bank, you negotiate directly with the seller, who may be more willing to work with your unique financial situation. We answer your burning questions like what is a VTB in real estate and how it can provide you with an opportunity to purchase a home that might otherwise seem out of reach.What is a VTB Mortgage and How Does It Work?If you can’t pay the full price for a home, you usually get a traditional mortgage. You use your savings and maybe equity from selling another home as a down payment, then apply for a mortgage through a bank for the rest. The lender checks your credit and finances. If you’re approved, you make an offer. Once accepted, the sale closes, the seller gets paid, and you owe the bank the loan amount plus interest. After that, your main dealings are with the bank.You may be wondering what a vendor take-back (VTB) mortgage is in real estate and why it’s becoming more popular. A VTB mortgage is different from a traditional one. Instead of getting a loan from a bank, you find a seller willing to act as the lender. This usually means the seller doesn’t have a mortgage on the property. You and the seller agree on the mortgage terms, including the down payment and interest rate, which is often higher than what banks offer. You make payments directly to the seller over the loan’s term, with the property as collateral. Unlike traditional mortgages, this setup creates an ongoing relationship between you and the seller, involving regular payments and potential further interactions if any issues arise.What is a VTB in Real Estate, and What are the Benefits?A VTB in real estate is a type of financing where the seller of a property also acts as the lender. This is especially helpful for buyers with poor credit, as it provides an alternative to traditional bank loans. There are various benefits to VTB financing for buyers and sellers alike.Flexibility in Mortgage TermsWith VTB mortgages, the terms are more flexible than with traditional bank loans. Buyers and sellers can negotiate terms that fit their needs, like the down payment, interest rate, and repayment schedule. This accommodates unique financial situations, making the home-buying process smoother. For example, a seller might accept a lower down payment in exchange for a higher interest rate or adjust the repayment terms to suit the buyer’s income pattern.Steady Cash Flow for SellersVTB mortgages provide sellers with a consistent income stream over the loan’s term instead of a one-time payment. A VTB provides a consistent and predictable income stream, particularly useful for retirees or those who need regular income for living expenses and long-term financial stability.Potential Tax Benefits for SellersSellers can also benefit from offering a VTB mortgage, particularly with tax savings. By receiving payments over time instead of a lump sum, sellers can spread their income across several years, potentially lowering their immediate tax burden. This steady income stream can help sellers manage their finances better and keep them in a lower tax bracket. Of course, professional advice is always recommended when it comes to taxes.Easier and Faster TransactionsSince VTB mortgages bypass many of the bureaucratic hurdles associated with traditional bank loans, they can lead to quicker and smoother transactions. Without needing bank approval, buyers and sellers can close deals faster. A buyer struggling to meet a bank’s requirements might secure a property more quickly through a VTB arrangement, benefiting both the buyer and the seller.Access to Larger MortgagesSometimes, VTB mortgages allow buyers to get larger mortgages than they might qualify for with traditional lenders. By negotiating directly with the seller, buyers can secure financing that better suits their needs, enabling them to purchase their desired property. A buyer might afford a larger home or a property in a more desirable location through a VTB mortgage than with a bank loan.Customizable Repayment SchedulesAnother benefit of VTB mortgages is the ability to customize repayment schedules. Buyers and sellers can agree on a plan that fits the buyer’s financial situation, like interest-only payments for a while or adjusting payments based on seasonal income. Customization makes it easier for buyers to manage their finances and stay on top of their mortgage, reducing the risk of default. Take a buyer with a seasonal business; they might be able to negotiate lower payments during the off-season and higher payments during peak times.Involving a real estate agent in a VTB mortgage brings numerous benefits for both buyers and sellers. If you’re looking for a home with a VTB mortgage or considering offering one for sale, trust RE/MAX for the support you need.Find a RE/MAX AgentThe post What is a VTB? appeared first on RE/MAX Canada.

Why Is Toronto so Expensive?

How much does it cost to live in Toronto? If you wish to live in the heart of North America’s fourth-largest city, you should be aware that the average price for a home in the Toronto real estate market was $1,114,267 (January 1-October 31, 2024). Put simply, it takes plenty of capital to live in Toronto.Now, by comparison, the national average home price sat just below $700,000 in October 2024, the Canadian Real Estate Association (CREA) notes. Even on the rental side of the Toronto housing market, the typical one-bedroom apartment is more than $2,400, based on a long-running monthly report. Evidently, housing costs and the overall cost of living in Toronto are much higher than in other municipalities, be it major urban centres or suburban towns. So, why is Toronto so expensive anyway?Let’s sift through some of the reasons why Toronto is expensive.Why Is Toronto so Expensive?According to data from Numbeo, the estimated monthly cost for a family of four is around $5,550 (without rent). For a single individual, the approximate monthly expenses are north of $1,500 (again, without rent).How does this compare with a city like, let’s say, Vancouver? In other words, is Vancouver more expensive than Toronto? Surprisingly, Numbeo statistics suggest that the cost of living, including rent, is a little more than five per cent lower than in Vancouver. Additionally, the data suggest that Toronto is the most expensive city in Canada, followed by Vancouver, Montreal, Ottawa, and Calgary. It is also the 90th most expensive city in the world.Of course, housing is the primary issue for many Torontonians. Everything from monthly mortgage costs to property tax rates to home insurance, buying a home in Toronto is a costly endeavour. While condominiums are priced lower than detached, semi-detached, or townhomes, the maintenance fees associated with condo living can be quite expensive.Why are Houses in Toronto so Expensive?It is a case of supply and demand.Toronto is the most populated city in Canada, and many newcomers are planting roots in Toronto. So, there is increased competition for limited supply for a city that suffered lacklustre housing inventories. Plus, the figures highlight that common things like garbage pickup and electricity can be quite elevated in Toronto.Unfortunately, the gap between household incomes and monthly living expenses (housing, utilities, groceries, and transportation) is widening, too. It is important to note that while the city is becoming more and more expensive to live in, the median income for people in Toronto has not witnessed comparable income gains. In 1990, the real (inflation-adjusted) median income for a prime working-age (25 to 54) individual in Toronto was about $54,000. Today, based on 2021 Census data, incomes have been relatively unchanged after reflecting inflation trends.Put simply, the cost of living has long surpassed any sizeable increase in median income.As The Toronto Star reported in October 2023: “While the average income for individuals in the Toronto area has increased since the 1990s, the median income is the same, according to census data, adjusted to inflation, suggesting pay has remained stagnant for the lowest earners, but increased somewhat for higher earners.”Even parking and traffic have metastasized into substantial problems in Toronto. This is why many individuals choose not to use an automobile and avoid the high expenses of car payments, auto insurance, and parking. At the same time, the costs can still be quite high for those who select public transportation as their primary mode of transportation, as a one-month transit pass in Toronto costs $156. This is one of the most expensive transit passes in North America.Toronto is Canada’s economic powerhouse. It is home to the five largest banks, major law firms, and large corporations. The Toronto Stock Exchange is the seventh largest in the world in terms of market capitalization. All these factors directly impact the cost of living in this city.Toronto Is Still a Great CityThe challenges gripping Toronto are happening in big cities nationwide. For years, many municipalities have possessed strict zoning regulations that limit the availability of land for development. The influx of new immigrants in Canada, record low mortgage rates, and changing consumer trends have all been factors that have influenced housing markets everywhere.Is it only a matter of trying to answer the age-old question of “Why is Toronto so expensive?” Or has the conversation evolved into “Why is Canada so expensive?”In the end, Toronto maintains a vibrant cultural hub in Canada. Despite its growing list of issues, Toronto continues to be an attractive destination for immigrants, single individuals, young couples, and families. Yes, homeownership is expensive, and rents continue to increase at a high pace, but what other Canadian city is not enduring these same developments?Find a RE/MAX AgentThe post Why Is Toronto so Expensive? appeared first on RE/MAX Canada.

What Is a Condo Special Assessment?

Over the last year, many cases of condominium special assessments have occurred. From Calgary to Toronto, real estate markets across the country are seeing a rise in tenants facing a special assessment on a condo suite. This is forcing many owners to endure thousands of dollars in extra costs or sell their suites for below-market prices to cover these special assessments.So, what are special assessments on a condo, anyway? Let’s examine this expense a bit more closely.What Is a Special Assessment on a Condo?A special assessment is a one-time charge added to condo owners’ common monthly fees. These special assessments serve two purposes. The first is to cover shortfalls in annual budgets without tapping into reserves. The second is to pay for unforeseen events, such as a damaged roof, expensive litigation, or severe floods, when the rainy-day fund is low on cash.Condo boards can slap a special assessment on tenants without receiving their permission.Some first-time homebuyers might have never heard of this before, and as a result, they would likely have some questions:How Much Will a Condo Assessment Cost?Many condo owners have one question: how much do they have to pay? The condo corporation will inform owners how much they must pay. Typically, the owner’s portion will be calculated by using the same percentage used to calculate common expense fees.What Happens If I Can’t Afford the Special Assessment or Choose Not to Pay?Should you not pay, the condo board will place a lien against your unit, which will help cover the unpaid amounts. The proceeds will be transferred to repair costs, legal expenses, and the interest.How Do I Avoid a Special Assessment?It can be hard to avoid a special assessment. Ultimately, the best strategy is to encourage financial management by the condo corporation. This can be hard to do, but one idea is to join the board and ensure it has the resources to cover emergencies. Additionally, be sure to check the building’s status certificate to find out its reserves and if there are any pending lawsuits.Are Condo Special Assessments Tax Deductible?Are condo special assessments tax deductible? This is a bit tricky. For now, the answer is that if your condominium is your primary residence and you are compelled to pay monthly condo fees, you cannot deduct these fees from your taxes. However, if this condo is a rental property, you might be able to deduct a special assessment or the condo fees from your tax returns. As with any tax-related challenge, it is always recommended to get in touch with the Canada Revenue Agency.How Common Are Special Assessments?With more buildings growing older, potential repair deferrals or a lack of maintenance could result in devastating consequences for the condo and its owners. As many boards maintain little reserves – this is becoming increasingly common for new ones – many cities and small towns are seeing condominiums facing special assessments.Growth of the Condo Special AssessmentIn June 2024, five condo buildings in a condominium complex outside of Ottawa were constructed in the 1980s on a sloping sedimentary foundation, according to CBC News. Four decades later, the buildings have leaky roofs, and the area is enduring crumbling walkways.The condo complex requests $600,000 for the repairs, amounting to as much as $20,000 per tenantIn December 2023, a north Edmonton building sought as much as $12,000 for a special assessment from 44 units. The Castledowns Pointe condominium building suffered fire damage in March, and engineers have also uncovered problems with the foundation, columns, walls, and students.In June 2023, a condo complex in Calgary faced a total special assessment cost of $500,000.These cases are popping up from coast to coast. In 2022, the Canadian Institute of Actuaries published a report warning that aging condos will need to make expensive repairs in the future.Industry experts say it is vital for condo buyers not to assume that the only monthly cost they will have is the condo fees. When sizeable damage happens, and there is not enough in the reserve fund to cover these mishaps, special assessments will be a reality of condo ownership.Experts warn that trouble could be brewing in the Canadian condo market in the next few decades. New condos on the market or newer projects in the middle of construction offer low monthly maintenance fees as a sales inducement. Therefore, when major upgrades, repairs, or replacements are needed, enough money might not be collected to cover these costs.While a crowd of condo owners might petition the board to keep monthly costs down, they might have to pay it in the future when repairs are deferred for too long and conditions deteriorate quickly.In the end, it is important to research the condo market, work with a trusted and experienced real estate agent, and determine how much is in the condo corporation’s reserve fund. With enough due diligence, you might save yourself thousands of dollars down the road.The post What Is a Condo Special Assessment? appeared first on RE/MAX Canada.

REVIEWS

- I met with the realtor Ahmed Arshad through Houseful online agency. He was very polite gentleman who knows his job and in very professional manner he sold our house in three days for very good price. Later he guided us to buy a new house. And he showed us how to be careful about some missing, or bad things in the houses we looked at. It was a very exciting adventure working with Mr Ahmed Arshad and for very short time we found and bought the house were now we live in. Thankful Kiro and LidijaKiro Seremetkoski

- Definitely will recommend to those who is looking for their new home.Jeric Salazar

- Erica Salazar

Our Team

1301 8th Street SW, Calgary, AB, Canada