2821 111 ST Rural Grande Prairie No. 1 County Of, AB T8W 5B5

UPDATED:

09/30/2024 06:10 PM

Key Details

Property Type Vacant Land

Sub Type Residential Land

Listing Status Active

Purchase Type For Sale

Subdivision Sunrise Estates

MLS® Listing ID A2098938

Originating Board Grande Prairie

Annual Tax Amount $1,234

Tax Year 2023

Lot Size 2.520 Acres

Acres 2.52

Property Description

Location

Province AB

County Grande Prairie No. 1, County Of

Zoning CR-5

Exterior

Fence None

Building

Lot Description Cleared, Creek/River/Stream/Pond, Lawn, Landscaped, Many Trees, Open Lot, Treed

Others

Restrictions None Known

Tax ID 85007360

Ownership Private,Registered Interest

MORTGAGE CALCULATOR

By registering you agree to our Terms of Service & Privacy Policy. Consent is not a condition of buying a property, goods, or services.

Go tour this home

2821 111 ST

- Any

- $ 100,000

- $ 150,000

- $ 200,000

- $ 400,000

- $ 800,000

- Any

- $ 100,000

- $ 150,000

- $ 200,000

- $ 400,000

- $ 800,000

MARKET SNAPSHOT

(DEC 07, 2024 - JAN 06, 2025)

MARKET SNAPSHOT

By registering you agree to our Terms of Service & Privacy Policy. Consent is not a condition of buying a property, goods, or services.

Why Choose Us

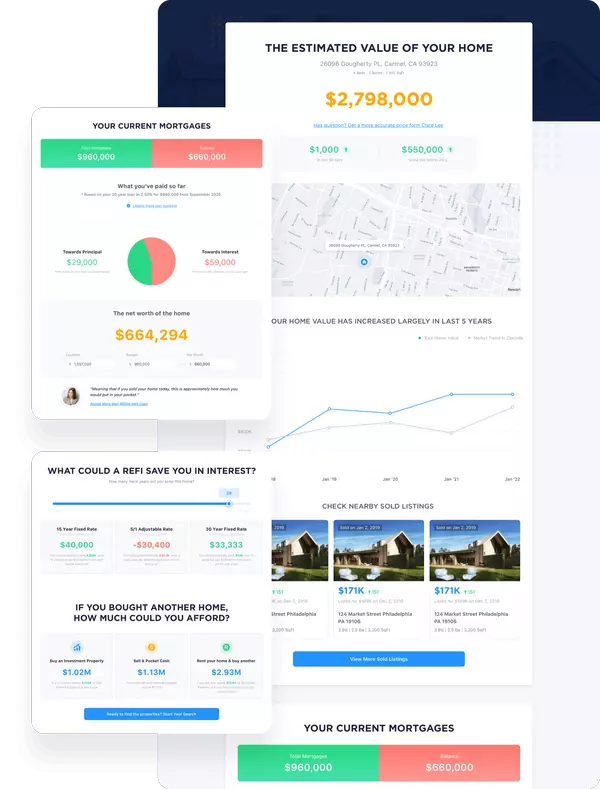

Free & Instant Home Valuation

Estimate how much you can get by selling your home and keep track as the market changes.

Sell Faster

Our team utilizes the power of online marketing to sell faster than an average real estate agent.

Save Money

Our experts help you sell for the highest price point possible.

MY BLOGS

Is a Real Estate Investment Still Profitable?

“Is real estate a good investment?” “Is buying a house a good investment, or is investing in a commercial property a better idea?” are just two of the questions that real estate agents get asked often. Long-term real estate investments have historically generated excellent returns. However, how much you pay for the property, how much it appreciates, and how long it takes to build an ROI comparable to or better than other investments varies greatly.If you’re wondering, “Is investing in real estate worth it?” read on and let us help you decide if it’s right for you.Average Rate of Return on Real EstateAre Real Estate Investments SafeSteps to Help You Get Started InvestingIs Buying a House a Good Investment?What is the Average Rate of Return on a Real Estate Investment?For most investors, the appeal of real estate as an investment vehicle is the promise of a strong overall return and the opportunity for a steady monthly income from the rental of the property to residential, multi-family or commercial tenants.But what does the data say? Let’s look at the numbers and determine what profits investors in real estate in Canada can expect.Understanding the Components of Real Estate ROIWhy is real estate a good investment? Two primary components contribute to real estate’s potential for a significant return on investment: capital appreciation and rental income.Capital appreciation refers to the increase in the property’s value over time. Rental income represents the revenue an investor could receive from tenants. The profits from both components vary based on factors such as the property type, location, condition and real estate market trends, as well as on external economic conditions.Capital AppreciationProperty prices tend to rise over the long term – and historically, real estate has been a good investment in terms of capital appreciation – but keep in mind that future market performance might not mirror past trends.So, is investing in real estate worth it? According to Canadian Real Estate Association (CREA) stats, there’s no doubt about it.Over the past few decades, the average annual rate of return for Canadian real estate investments has been around 7-10% for residential properties and 8-12% for commercial properties.And what’s more, the CREA HPI (Home Price Index), which tracks prices in 60 areas (in 9 provinces and 51 cities or residential areas), shows that over the past 10 years:There is no area tracked where the HPI has declined in the last decade.The lowest of the 51 areas tracked increased by 5.2%The highest of the 51 areas tracked increased by 220.4%35 of the 51 areas tracked saw an increase of 100.0% or moreThe average of the 51 areas tracked is a 109.1% increaseBecause this sort of rapid appreciation isn’t the norm, it shouldn’t be the only reason to invest in real estate, and that’s where rental income comes into play.Rental IncomeRental income, the other important component of ROI, can provide a steady income stream to property investors. Typically, rental yield, or annual net rental income expressed as a percentage of the property’s value, ranges between 3% and 5% for residential properties.Combining The Annual Return from Capital Appreciation and Rental IncomeOver the past decade, the combined annual return from capital appreciation and rental income has ranged from 8% to 10%. Again, this is simply an average, and individual returns can vary widely, as illustrated in the stats above,Are Real Estate Investments Safe?As long as you buy property at the right price in an area where market data gives you confidence that the value will rise, real estate is safe and lucrative.In fact, real estate tends to have less volatility when compared to stocks and bonds. With real estate, you can minimize risk by holding on to your property longer should there be a drop from the price you paid and continue to build equity as you wait for prices to rebound. When you’ve built enough, you can leverage your equity to qualify for HELOCs and home equity loans, which can help you renovate or invest in more property.Real estate is a safe investment because:It will almost always increase in value over timeIt has a high tangible asset valueIt adds diversity and helps reduce risk in your overall investment portfolioIt comes with tax benefitsSteps to Help You Get Started InvestingProperty investment takes planning and budgeting. Here are some steps to help you get started:Clear Your DebtsStart paying down your debt as soon as possible to establish a strong credit rating. This step is also crucial as the less debt you carry, the easier it is to qualify for a mortgage.Start SavingAs your debt is paid down, start putting money aside for the down payment on your first property. Make this a habit, and the next thing you know, you‘ll be ready to purchase your first residential or commercial property.Do Your ResearchImportant things to research and explore include real estate investment tactics and timing, how to evaluate market trends and how to find up-and-coming neighbourhoods in your city.Find a Trusted AgentWork with a trusted agent to find the best properties with the best growth potential.Find Your First PurchaseIf you don’t already own your own home, you’ll need to save enough for your down payment and scope out your first potential purchase. What you want is a small, affordable house in an up-and-coming neighbourhood to help ensure you can sell it for more later. It’s best to put down at least a 20% down payment, as not only does your down payment directly affect the mortgage amount you borrow and the mortgage terms you get, but it also impacts what you’ll pay in interest over the life of your mortgage. Additionally, you won’t need to buy mortgage insurance. It’s also a good idea to only purchase a home with mortgage payments less than your current rent.Save AgainContinue to save so that you can look for your next property. You’ll want to make this one a space you can rent to a tenant, so make sure you are buying in an area that will provide you with enough rent to fully cover your mortgage payments plus all applicable taxes and home insurance. Don’t overlook fixer-uppers that you can upgrade with minimal investment to get more rent. Ideally, you will not just break even but also accumulate a few hundred dollars per month to put toward your next real estate purchase. This money will also come in handy to cover maintenance costs.Pay Down Your MortgagesYour goal should always be to pay down your mortgage as soon as possible. If you pay off your mortgage or see a potential gain in selling your home, that’s how you begin to grow your real estate portfolio.Is Buying a House a Good Investment?For the rookie real estate investor, purchasing a house represents the best of both worlds. As a rental property, it can provide an additional income while offering an investment that will also appreciate over time.You can choose from two types of rental opportunities:Single-family: You rent out the entire house or condo to one tenant.Multi-family: You rent separate units to separate tenants on each floor.Many factors will affect how much you can make from each type of rental investment. Here is a comparison between the two:Single Family HomesAdvantages:Typically appreciate fasterEasier to sell, making them more liquidJust one tenant to find and deal withNo need to worry about complaints and issues among tenantsEasier to collect bills and set up utility paymentsEasier to financeDisadvantages:In most cases, there will be less cash flow generated than with a multi-family homeCan be riskier if you end up with a bad tenant who does not pay rent or skips outHarder to find a good tenant as you have to charge quite a bit for rentNo economies of scale if you want to hire a property managerMulti-Family HomesAdvantages:Better cash flow with more unitsLower unit price makes it easier to find tenantsIf one tenant is a dud or moves, you still have the cash flow to help cover your expensesEconomies of scaleLess expensive to manage on a per-unit basisDisadvantages:Higher maintenance costs due to more people, more appliances to repair, more tenant turnover, and so onTakes more of your time as there are more tenants to worry about, collect rent fromSlower appreciation in valueFewer buyers when you want to sellMore potential tenant complaints about things such as noise, messiness, smells and moreMore challenging to find financingIs Real Estate a Good Investment? You Asked, We AnsweredReal estate investment lets people grow their net worth by amassing more and more properties. It’s a good investment in the long term due to appreciation and the potential for steady rental income to cover the mortgage, maintenance costs, and other costs. As you pay down your mortgage, you build equity, which can be leveraged to help you land a HELOC or home equity loan to finance renovations that will drive your home value higher or help finance your next property.Since the real estate market is substantially less volatile than the stock market, investing in real estate is considered less risky than investing in stocks and bonds, making real estate a safer investment than many other options. As well, by adding real estate holdings to your overall investment portfolio, you add diversification that can help when other investments experience pullbacks.Ready to start on the road to real estate investing? Connect with a RE/MAX agent and see the difference that adding an experienced real estate professional to your investing team can make.Find a RE/MAX AgentThe post Is a Real Estate Investment Still Profitable? appeared first on RE/MAX Canada.

How Do You Buy a House Before Selling One?

The COVID-19 pandemic turned Canada’s housing market on its head. Many had anticipated a significant crash in the early days of the public health crisis, but the opposite transpired, with a big change in consumer buying and selling patterns.Many Canadian homeowners, eager to take advantage of enormous equity gains on their residential properties – and with remote work an HR-sanctioned option for accomplishing most day-to-day tasks – chose to sell and move elsewhere in search of a bigger place or a quieter way of life. The resulting increase in the demand for homes and a shortage of listings created strong seller’s markets across the country. With the home-buying process suddenly more challenging, many homeowners decided to play it safe by committing to buying a house before selling theirs. But how does buying a second home before selling the first actually work?How to Buy a House Before Selling YoursCan you buy a home before selling yours in a timely manner, or do you risk paying for two mortgages at once? There are definitely risks as well as pros and cons involved with buying a house before selling, so let’s examine those, as well as the pros and cons of the reverse situation, so you have all the information you need before deciding what to do next.The Pros & Cons of Buying a House Before SellingPros:Provided you have the downpayment ready and the funds needed to close the deal, opting to purchase a new home before selling your current one creates a more relaxed move-in timetable and gives you the opportunity to do pre-move-in cleaning, repairs, renovations, appliance switchouts, painting and decorating.Buying first allows you to wait for optimal market conditions to sell your current home and maximize your sale price. However, buying first will mean you risk carrying two mortgages simultaneously, increasing your financial strain while you wait for those conditions to materialize.You’ll also be on the hook for double the monthly utilities, property taxes, maintenance, and other expenses if you own two homes simultaneously. If you wait too long to sell your old home, these expenses could end up eating away at your profit.Cons:Selling a home first provides funds that can be used for a down payment and other costs associated with buying a home. By buying first, you won’t have this financial windfall.You run the risk of carrying two mortgages if your old home takes a while to sell or if you can’t coordinate the closing date of your newly purchased house with the closing date for the sale of your old house.If you get nervous about being able to coordinate closings, you might be tempted to “price or negotiate to sell,” resulting in money being left on the table versus in your pocket.If your old home sells for less than anticipated, you could come up short concerning the monies needed for your new purchase. If it sells for more than you expected, you might regret missing out on buying a new house that was a better fit, albeit more expensive.Bridge financing is expensive and can typically only be obtained if you have a firm offer on both your purchase and sale.Four Tips for Making Buying a House Before Selling Smooth SailingHere are four tips designed to help make buying a second home before selling the first as smooth a process as possible:Enlist the Services of an Experienced Real Estate ProfessionalWorking with an experienced real estate agent will help you navigate all the moving parts involved in buying a house before selling and keep each deal on track and moving forward. This is especially important if you’re trying to coordinate two closing dates for both buying and selling parties.Ask your agent to show you market data for recent home sales in your area and the number of listings available in the area you want to move to in order to help you understand whether you have a real chance of coordinating closing dates or if your current house is likely to sell before you can buy.Your real estate agent will also discuss:Your personal financial situation (home equity, down payment, whether you should apply for a line of credit if you don’t already have one, and other financial matters).Timeline (see below)Repairs, upgrades and staging that might be required to get the best price on your current home.Get Pre-Approved for a MortgageYou’ll want to do this early on so you can start house-hunting as soon as possible. When reviewing possible mortgage lenders, ask if they offer bridge loans and their rate, in case you need one.If you’re unable to coordinate closing times, once you move into your new home, explore renting out your old house instead of selling it for less. While you’ll be taxed on the rental income when year-end comes around, you’ll also be able to deduct costs for utilities, etc., and you’ll be less tempted to take a significant hit on price just to get the deal done.Understand Your TimelineThe timing involved in buying a second home before selling the first can be the most challenging part of a simultaneous buying-and-selling process.Typical steps include:Preparing Your Current Home for Sale: Making your home as attractive as possible to prospective buyers is critical, so staging your home might be necessary.Shopping for Your New Abode: The next step is shopping for a new home, be it a single-family detached, a condominium suite or one of the many other options. Consider adding a condition of sale into the purchase agreement of your new home, so if you haven’t sold your old one, you can back out of the new purchase without losing your deposit or incurring other penalties.Have a Real Estate Lawyer Prepare/or Review All Contracts: Always ensure a real estate lawyer creates/or reviews the contracts involved in your various transactions.Timing Your Closings: Depending on your agreement of purchase and sale, the length of your closings could range from a few weeks to a few months. Make sure you build in enough time for both you and the buyer of your old home to conduct your home inspections and appraisals and complete the myriad of tasks involved with buying and selling a home.Closing the DealsIn a best-case scenario, on closing day, your attorney will organize all financials, pay off the mortgage and disburse moneys for real estate commissions, lawyers, etc., using the money paid by the buyer of your old home. Then, the entire remainder of the profit from that sale, a designated portion of it or a combination of both the profit and monies from the new mortgage will be sent to the lawyer representing the seller of the new home you’re purchasing. This results in everyone involved in the transaction getting paid – usually on the same day – allowing both deals to close simultaneously.Here’s how it works:Suppose your old home sells for $500,000, the remaining mortgage amount on it is $300,000, and the new house you’re purchasing is $600,000.The real estate lawyer receives the $500,000 from the buyers who purchase your old home. He then makes the necessary payments to all parties, including himself.Let’s say you are left with $150,000 profit after costs, fees and disbursements. Depending on your direction, your attorney will then transfer all or some of the $150,000 to the lawyer representing the property you are buying, and your new mortgage will cover whatever final amount is owed.Although complex, it’s not uncommon for all these transactions to be completed on the same day.If the closing dates do not align, your lending institution can extend you a short-term “bridge loan” at a high interest rate. This is a valuable tool if the deal on the home you are selling closes after the deal on the home you are purchasing.How Does the Market Factor into Buying a Second Home Before Selling the First?In a competitive market, you can use the equity in your current home to secure bridge financing that will allow you to make a down payment on your new home. When you sell your old house, you can use the proceeds to pay off the bridge loan.Can You Buy a Home Before Selling Yours?Even the most straightforward real estate processes can be confusing for most. Hopefully, you now understand the basics about how to buy a house before selling yours, and because you will soon have two real estate transactions under your belt, you’re likely more knowledgeable than many on the subject. Of course, one of your most-valuable resources in the home-buying and selling process will be a professional real estate agent, ready to guide you through the nuances of your particular transaction.Find a RE/MAX AgentThe post How Do You Buy a House Before Selling One? appeared first on RE/MAX Canada.

Closing: Understanding your Legal Buyer Obligations

After weeks or months of viewing and bidding on properties, your offer on the house of your dreams has been accepted. Now what? At this point, typically, there is a bit of a waiting period. The closing date in real estate is defined as the day the buyer officially becomes the owner of a property after all the legal and financial aspects of the transaction are complete. The closing date is when the buyer becomes the legal owner of a property. Closing periods – the time it takes to complete the closing tasks – can take several weeks to a few months, but some essential buyer obligations must happen quickly.H2 How Long Does It Take to Close on a House?The buyer and seller typically agree on the closing date in real estate when the Agreement for Purchase and Sale (a legally-binding contract) is signed. The contract often sets the closing date at 30 to 60 days after the agreement, but the buyer and seller may stipulate that the closing date can be changed or extended if both parties agree.If there were any conditions within the offer, there’s a period during which the buyer/or seller must take all the necessary steps to fulfill them. This may include the buyer securing mortgage financing, hiring a professional to conduct a home inspection of the property – and everything else that needs to happen before you officially seal the deal – which could even include the buyer selling their old residence or the seller closing on a new one.Realistically, how long does it take to close on a house? The simple answer is it depends. There are many reasons that a closing date might need to be extended. Here are just a few:Problems with the Appraisal of the PropertySince a buyer will not be able to borrow more than a certain percentage of the value of the house, if the bank appraises the house at just $500,000 and you offered $750,000, you’d be required to come up with the additional $250,000. If you still want the house, while you scramble to come up with the cash, you might need to extend your closing.Problems with the Documentation Required for Mortgage ApprovalCopious amounts of paperwork are involved in each mortgage approval. A delay in submitting any of the documentation demanded by the bank could delay your closing date.Discrepancies in the Property SurveyThe real estate closing must be based on clear, accurate information to be binding, so the survey must accurately represent the current state of the property. If you were erroneously awarded ownership of your neighbour’s fence, it could turn into a future legal battle, and nobody wants that.Issues with the Property Title SearchThe title to the property must be completely owned by the seller with no other party able to claim ownership. A title search is also done to ensure there are no liens or other potential claims on the property before it’s deeded to a new owner. The search and verification process could be extensive if the title was not updated in recent years.H2 What to Do During the Home InspectionYour building inspector will discuss their overall approach and how their findings will be shared with you. Your real estate agent will be able to advise you as to the most likely strategy to be taken by building inspectors in your area.If permitted, consider accompanying the inspector throughout the home inspection process, which usually takes about three hours. This will allow you to learn as much as possible about the various home systems: heating, plumbing, electrical, and roofing. The home inspection may also identify some repairs that need to be made so that you have a better idea of the home’s condition before proceeding with the deal.At the end of the conditional period – with any adjustments or repairs made to your satisfaction – your real estate agent will finalize the deal, and your lawyer will process the paperwork, including the mortgage documents, with your lender. All of this will point to a final date of actual legal possession: The real closing date in real estate.H2 What Happens Leading Up to Closing DayAs a buyer, it is essential to understand your legal obligations at closing to ensure a smooth and successful transaction.The following things will happen leading up to the date of closing:IMAGESH3 Signing the DeedKeep Text As IsH3 Closing DisclosureKeep Text As IsH3 Paying Closing CostsKeep Text As IsThe transactions will be processed through your lawyer and bank on the possession date. Once they are complete, you can get your keys and start moving in!H2 Post-Closing ObligationsThe work doesn’t stop once the closing date has passed.There are several post-closing obligations that buyers must meet to ensure a smooth transition and avoid potential legal issues, including:The transactions will be processed through your lawyer and bank on the possession date. Once they are complete, you can get your keys and start moving in!H2 Post-Closing ObligationsThe work doesn’t stop once the closing date has passed.There are several post-closing obligations that buyers must meet to ensure a smooth transition and avoid potential legal issues, including:In addition to the critical post-closing obligations, there may be other tasks that the buyer needs to complete depending on their specific circumstances. For example, if the property is part of a homeowners association (HOA) or condo association, the buyer may need to pay condo fees and follow additional rules or regulations.Failing to meet post-closing obligations can result in legal issues, financial penalties, or property loss. Seeking professional help from a real estate attorney or agent can help ensure that all post-closing obligations are met and that the transition to homeownership is smooth and successful.H2 Still Have Closing Questions?Understanding your legal obligations as a buyer upon closing is a crucial part of the home-buying process. Hopefully, you feel more informed about the closing date in real estate and the closing date vs move in date.If you still have questions – and even if you don’t – remember to seek professional help from a real estate attorney or RE/MAX agent to ensure all your closing obligations are met and the home purchase goes smoothly. Before long, you’ll be settled in the new place you call home.Connect with a RE/MAX agent and see the difference that adding an experienced real estate professional to your closing team can make.Find a RE/MAX agentThe post Closing: Understanding your Legal Buyer Obligations appeared first on RE/MAX Canada.

REVIEWS

- I met with the realtor Ahmed Arshad through Houseful online agency. He was very polite gentleman who knows his job and in very professional manner he sold our house in three days for very good price. Later he guided us to buy a new house. And he showed us how to be careful about some missing, or bad things in the houses we looked at. It was a very exciting adventure working with Mr Ahmed Arshad and for very short time we found and bought the house were now we live in. Thankful Kiro and LidijaKiro Seremetkoski

- Definitely will recommend to those who is looking for their new home.Jeric Salazar

- Erica Salazar

Our Team

1301 8th Street SW, Calgary, AB, Canada