Ontario Cottages Could See Price Gains in 72% of Markets

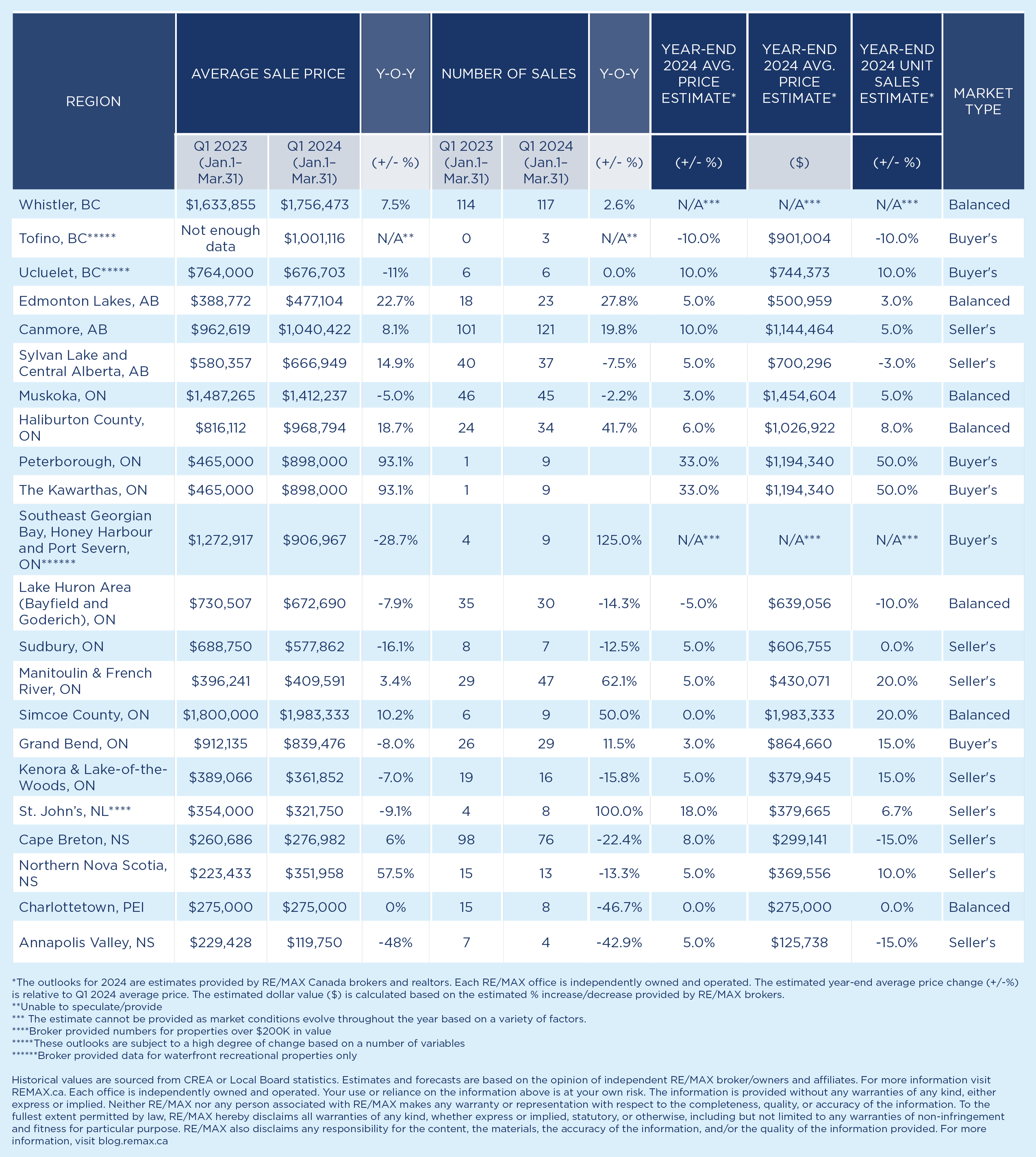

The price of Ontario cottages fell in the first quarter of 2024 in 54 per cent of markets analyzed, according to the 2024 RE/MAX Cottage Trends Report. Year-over-year declines range between five and 28.7 per cent. Among these markets are Muskoka (down five per cent, from $1,487,265 Q1 2023 to $1,412,237 in Q1 2024); Kenora and Lake-of-the-Woods (down seven per cent, from $389,066 in Q1 2023 to $361,852 in Q1 2024); Grand Bend (down eight per cent, from $912,135 in Q1 2023 to $839,476 in Q1 2024); Sudbury (down 16.1 per cent, from $688,750 in Q1 2023 to $577,862 in Q1 2024); and Southeast Georgian Bay, Honey Harbour and Port Severn (down 28.7 per cent, from $1,272,917 in Q1 2023 to $906,967 in Q1 2024).

Meanwhile, regions that experienced price increases include Manitoulin & French River (up 3.4 per cent, from $396,241 Q1 of 2023 to $409,591 in Q1 2024); Simcoe County (up 10.2 per cent, from $1,800,000 in Q1 2023 to $1,983,333 in Q1 2024); Haliburton County (up 18.7 per cent, from $816,112 in Q1 2023 to $968,794 in Q1 2024); and most notably, Peterborough and The Kawarthas (up 93.1 per cent, from $465,000 in Q1 2023 to $898,000 to Q1 2024).

For the remainder of 2024, RE/MAX brokers and agents are expecting the price of Ontario cottages to increase in 72 per cent of recreational markets, to the tune of up to 33 per cent. The outlier is Simcoe County, where prices are likely to remain steady year-over-year, due to the interest rate climate.

On the sales side, some Ontario markets are showing promise, with significant year-over-year increases in the first quarter of 2024. Sales in Grand Bend were up 11.5 per cent (from 26 sales in 2023 to 29 in 2024); up 41.7 per cent in Haliburton County (24 sales in 2023 to 34 in 2024); up 50 per cent in Simcoe County (six sales in 2023 to nine in 2024); and up a whopping 800 per cent in Peterborough and The Kawarthas (from one sale in 2023 to nine in 2024). The sales outlook for the remainder of the year remains focused on growth in all regions surveyed, with an anticipated year-end sales increase of between three to 50 per cent, except for Sudbury, which is anticipating prices to remain steady.

Similar to RE/MAX report findings in 2023, there’s a nearly even split among Ontario markets analyzed that are favouring buyers (Grand Bend, Peterborough, The Kawarthas and Southeast Georgian Bay, Honey Harbour and Port Severn), sellers (Sudbury, Manitoulin, French River and Kenora/Lake-of-the-Woods) or experiencing balanced conditions (Muskoka, Haliburton County and Simcoe County). While most Ontario recreational property owners are holding onto their cottages, even amid affordability challenges, RE/MAX brokers in regions such as Muskoka and Haliburton County – two of the most popular cottage markets in the province – have reported a flood of sales, compared to other Ontario regions.

Demand for cottages in Ontario is driven primarily by families in nearly all markets surveyed, with the exception of Grand Bend. This is followed by young couples, a notable trends in 63 per cent of markets including Muskoka, Haliburton County, Peterborough and The Kawarthas, Southeast Georgian Bay, Honey Harbour, Port Severn, Lake Huron Area (Bayfield and Goderich) and Kenora/Lake-of-the-Woods. Retirees are also prevalent in 54 per cent of markets including Peterborough and The Kawarthas, Southeast Georgian Bay, Honey Harbour and Port Severn; Grand Bend, Lake Huron Area (Bayfield and Goderich) and Kenora/Lake-of-the-Woods.

While out-of-province buyers are an increasing trend in recreational markets in Atlantic Canada and Alberta, Ontario’s cottage buyers are generally local to the province, with the exception of Kenora and Lake-of-the-Woods, which sees interprovincial buyers primarily from Manitoba, due to its proximity to the neighbouring province.

When it comes to amenities, waterfront properties are in highest demand among Ontario cottage buyers, followed by properties with lots of outdoor and green space, and good Wi-Fi access.

National Cottage Market Outlook

From a Canada-Wide perspective, a flood of listings hasn’t hit the recreational property market this spring, and is unlikely to transpire this year. Despite the affordability challenges and higher interest rates that characterized the 2023 real estate market, Canada’s cottage owners are choosing to hold on to their properties in 2024 rather than selling off – a trend that’s likely influenced by the desirable quality of life alongside the prospect of future returns on recreational property ownership. Looking ahead, RE/MAX brokers and agents in Canada are anticipating a national average price increase of 6.8 per cent. Meanwhile, the number of sales is expected to rise in the majority of regions analyzed (61.9 per cent), increasing between three per cent upwards of 50 per cent this year.

Market-By-Market Overview

MUSKOKA, ON

Muskoka is experiencing a balanced market, with an increase of inventory currently. With mortgage rates set to drop mid-year, the local market could experience an influx of buyers coming to the table ready to purchase. Families, couples (including young and middle-aged couples) and investment buyers are driving property sales. This trend is expected to continue in 2024.

Average recreational sale price across all single-family waterfront properties, decreased by five per cent year-over-year (from $1,487,265 in Q1 2023 to $1,412,237 in Q1 2024). Meanwhile, the number of sales across all property types decreased by 2.2 per cent year-over-year (from 46 in Q1 2023 to 45 in Q1 2024).

Looking ahead, average price is likely to increase by three per cent by the end of 2024, and sales could increase by five per cent, due to high inventory and many buyers still looking for recreational properties.

Buying & Selling In Muskoka

Due to the warmer than normal weather in Muskoka, along with lack of snow, the cottage market heated up quite early this year. Sellers were able to get their waterfront properties listed much earlier than in previous years. There is typically a small slowdown mid-March which happened this year as well.

Most buyers are coming from the Greater Toronto Area and Hamilton. This is the same as last year.

The features and amenities most in demand among property buyers in 2024 are:

- Large properties with more outdoor/green space

- Waterfront properties

- Good Wi-Fi access

Many property owners were trying to offload cottage properties in 2022/2023 in the wake of COVID-19, due to market conditions and the interest rate climate, however the market has stabilized. Regulations such as short-term rental permits don’t seem to be impacting the local market in Muskoka.

Advice for Buyers

- Work with a local agent.

- The recreational market is complex- from private roads and road access issues, septics and wells, lake restrictions, and more- you need a local agent who knows the area and properties.

HALIBURTON COUNTY, ON

Haliburton County is experiencing a balanced market, with more inventory coming on stream. With mortgage rates expected to drop mid-year, an influx of buyers is expected to come to the table, ready to purchase. Families, couples (including young and middle-aged couples) and investment buyers are driving property sales – a trend that is expected to continue.

Average recreational sale price across all single-family waterfront properties increased by 18.7 per cent year-over-year (from $816,112 in Q1 2023 to $968,794 in Q1 2024). The number of sales across all single-family waterfront properties, increased by 41.7 per cent per cent year-over-year (from 24 in Q1 2023 to 34 in Q1 2024).

Looking ahead, average sale prices are expected to increase by six per cent by the end of 2024, and sales are likely to increase by eight per cent, due to high inventory and many buyers still looking for recreational properties.

Buying & Selling in Haliburton

Due to the warmer than normal weather in Haliburton County, along with lack of snow, the cottage market heated up quite early this year. Sellers were able to get their waterfront properties listed much earlier than in previous years. There is typically a small slowdown in mid-March, which also happened this year.

Most buyers are coming from the Greater Toronto Area and Hamilton, a trend consistent with last year. The features and amenities most in demand among property buyers in 2024 are:

- Large properties with more outdoor/green space

- Waterfront properties

- Good Wi-Fi access

Many property owners were trying to offload cottage properties in 2022/2023 in the wake of COVID-19, but currently, the market has stabilized.

Regulations such as short-term rental permits are required in many of the local municipalities, but are not affecting the local market a great deal.

Advice for Buyers

- Work with a local agent.

- The recreational market is complex- from private roads and road access issues, septics and wells, lake restrictions, and more- you need a local Agent who knows the area and properties.

PETERBOROUGH & KAWARTHA LAKES, ON

The recreational market in Peterborough and Kawartha Lakes is currently experiencing conditions favouring buyer’s, with 44 new listings in Q1 of 2024, compared wth only nine last year. Families, couples (including young and middle-aged couples) and retirees are driving property sales – a trend that is expected to continue.

Average recreational sale price across all single-family waterfront properties increased by 93.1 per cent year-over-year (from $465,000 from one sale in Q1 2023 to $898,000 from nine sales in Q1 2024). Meanwhile, the number of sales across all recreational properties increased by 800 per cent year-over-year (from one in Q1 2023 to nine in Q1 2024).

Looking ahead, average sale prices are likely to increase by 33 per cent by the end of 2024, and the number of sales could rise by 50 per cent. Along with the increase in inventory, the region is experiencing its best start in more than 10 years, so record numbers could be in store this year.

Buying & Selling in Peterborough & Kawartha Lakes

Homes in Peterborough and Kawartha Lakes are selling 60 per cent faster in Q1 2024 than they did in Q1 2023. New listings are way up in 2024 year-over-year, and months of inventory have also dropped, from an average of 22 months in Q1 2023 to only 11 months in Q1 2024.

Most buyers are coming locally, from Peterborough, Kawartha Lakes and the Greater Toronto Area. This has not changed much since last year. The features and amenities most in demand among property buyers in 2024 are:

- Waterfront properties

- Large properties with more outdoor/green space

- Access to recreational activities (i.e. skiing, water sports)

Peterborough and Kawartha Lakes are getting off to the best start in over 10 years. There are 50 per cent more sales in unit sales compared to 2021 and 2022. Along with the increase in inventory, the region is heading in the right direction, so expect to see record numbers.

Advice for Buyers & Sellers

- Buyers: There is a great selection of inventory currently to look at.

- Sellers: Market indicates a great recreational property for 2024. Now is the time to get your property on the market, while buyers are looking.

HONEY HARBOUR, ON (Southeast Georgian Bay, Honey Harbour and Port Severn)

Honey Harbour is experiencing a buyer’s market with a 16-per-cent absorption rate (sales vs properties for sale). Families, couples (young and middle-aged) and retirees are driving the waterfront-only recreational property sales. This trend is expected to continue, but, with new federal budget changes, it is difficult to say for sure.

The 2024 average residential sale price across waterfront recreational properties declined by 28.7 per cent year-over-year (from $1,272,917 in Q1 2023 to $906,967 in Q1 2024). It is important to note that there are few sales in the first quarter of each year, which makes year-over-year comparisons a challenge. The number of sales across all waterfront-only recreational properties increased by 125 per cent year-over-year (from 4 in 2023 Q1 to 9 in 2024 Q1).

The local market is too unpredictable to predict average sale prices and the number of sales in the region, especially with the new tax rules.

Buying & Selling in Honey Harbour

Honey Harbour is in a buyer’s market, moving toward a balanced market. Median days on the market is 31 days. The region has a better than average supply of listings for this time of year, and a better than average result selling them. The first quarter of 2023 was a quieter market than Q1 2024. With higher interest rates and buyer expectations that listing prices would fall, many buyers were taking a ‘wait and see’ approach. Buyers in the market have more ‘want’ than ‘need’ motivation.

Buyers are coming from the Greater Toronto Area and Golden Horseshoe geographies. This is the same as 2023. The features and amenities most in demand among residential property buyers in 2024 include:

- Waterfront properties

- Access to recreational activities

- Good Wi-Fi access

It is difficult to say at this time whether regulations such as short-term rental restrictions are having an effect, as the federal budget changes to capital gains were just announced, and local municipal regulations for short term rentals has been recently implemented.

Advice for Buyers & Sellers

- Buyers-as with every year, good properties are in short supply. Be proactive. Engage in a search sooner rather than later.

- Sellers-It is wise to get your property on the market early due to the probability of buyers being more confident this year.

SUDBURY, ON

Sudbury is currently experiencing a seller’s market, with a shortage of inventory, and high demand due to Sudbury’s relative affordability compared to other Ontario markets. Families are driving the bulk of recreational property sales – a trend that is expected to continue.

Average recreational sale price declined by 16.1 per cent year-over-year (from $688,750 in Q1 2023 to $577,862 in Q1 2024). The number of recreational property sales decreased by 12.5 per cent year-over-year (from 8 sales in Q1 of 2023 to 7 sales in Q1 of 2024).

Looking ahead, average sale prices are likely to increase by five per cent by the end of 2024, and the number of recreational property sales are expected to hold steady this year.

Buying & Selling in Sudbury

Sudbury’s recreational property market is weather-dependent, with nicer spring weather often resulting in an increase in sales. Currently, inventory is low. Intra-provincial buyers are coming from Northern Ontario, along with some Southern Ontario regions. This trend has remained consistent year-over-year. Since COVID-19, there has been an increase in the number of Southern Ontario buyers.

The features and amenities most in demand among residential property buyers in 2024 include:

- Large properties with more outdoor/green space

- Waterfront properties

Advice for Buyers

- Work with a local realtor.

- Start early, do your homework (e.g. recreational financing).

- Be patient.

MANITOULIN & FRENCH RIVER, ON

The recreational property markets in Manitoulin & Franch River are favouring sellers. There is currently a shortage of inventory, due to the affordability of these regions, compared to the remainder of the province. Families are driving the recreational property sales. This trend is expected to continue.

Average recreational sale price across all property types, increased by 3.4 per cent year-over-year (from $396,241 in Q1 2023 to $409,591 in Q1 2024). Meanwhile, mumber of sales across all property types increased by 62.1 per cent year-over-year (from 29 in 2023 Q1 to 47 in 2024 Q1).

Looking ahead, average sale prices are likely to increase by five per cent by the end of 2024, and the number of sales are expected to increase by 20 per cent this year.

Buying & Selling in Manitoulin & French River

Similar to Sudbury, these recreational markets are dictated by the weather. The timely arrival of spring brings nicer weather, which often prompts more buyer interest and an increase in sales. Inventory in Manitoulin and French River is low.

Intra province buyers are coming from Northern Ontario, along with some Southern Ontario regions. This has not changed since last year. Since COVID-19, there has been an increase in the number of Southern Ontario buyers. The features and amenities most in demand among residential property buyers in 2024 include:

- Large properties with more outdoor/green space

- Waterfront properties

Advice for Buyers

- Work with a local realtor.

- Start early, do your homework (e.g. recreational financing).

- Be patient.

SIMCOE COUNTY, ON

Simcoe County is experiencing a balanced market, with interest rates holding some buyers back, along with a limited number of listings. Families are driving the bulk of recreational property sales. As the Lake Simcoe waterfront is transitioning to year-round living, cottages in their traditional sense are becoming less common.

The 2024 average residential sale price across all residential property types increased by approximately 10.2 per cent year-over-year (from $1,800,000in Q1 2023 to $1,983,333in Q1 2024). The number of sales increased by 50 per cent year-over-year (from six sales in Q1 of 2023 to nine sales in Q1 of 2024).

For the remained of 2024, average sale prices are expected to stay level by the end of 2024. If interest rates drop there could be more activity, which would increase price, but not anything substantial. Meanwhile, the number of sales may increase by 20 per cent depending on the amount of properties available.

Buying & Selling in Simcoe County

Simcoe County has finally returned to a pre-pandemic market, with average days of market hovering around 200, balanced conditions, and buyers taking their time browsing the limited number of listings. This is similar to conditions experienced in 2023.

Intra-provincial buyers are coming from the Greater Toronto Area. The features and amenities in highest demand in 2024 include:

- Good Wi-Fi access

- Waterfront properties

Regulations such as short-term rental restrictions have forced some investment owners to sell, however most buyers in the region are purchasing cottages for personal use.

Advice for Buyers

- Deal with a local agent who has knowledge of the area, lakes, regulations and restrictions.

- Use a knowledgeable agent and understand that the market time frame could be longer than they would like, and that patience will help in bringing a successful sale.

GRAND BEND, ON

The cottage market in Grand Bend is currently favouring buyer, with abundant inventory and wide availability of different property types. Retirees and investment buyers are driving the majority of recreational property sales in the region – a trend that is likely to continue.

The 2024 average sale price in Grand Bend decreased by eight per cent year-over-year (from $912,135 in Q1 2023 to $839,476 in Q1 2024). The number of sales across all property types increased by 11.5 per cent year-over-year (from 26 in 2023 Q1 to 29 in 2024 Q1).

Looking ahead, average sale prices are expected to slightly increase by around three per cent by the end of 2024, and sales are expected to increase by 15 per cent by the end of 2024.

Buying & Selling in Grand Bend

Grand Bend’s recreational property market has shifted from balanced conditions to a buyer’s market, with the increased inventory and higher interest rates still keeping some buyers on the sidelines. Intra-provincial buyers are typically coming to Grand Bend from southwestern Ontario and the Greater Toronto Area. Buyers from the Greater Toronto Area have increased steadily over the last five to 10 years, and the trend of American buyers coming up from Michigan stopped.

The features and amenities most in demand among buyers in 2024 include:

- Access to recreational activities – beach, nature trails

- Waterfront properties

- Quiet setting and nature

Property owners in the region have been offloading cottages, due to affordability challenges. Particularly in the past couple of years and especially with interest rates, buyers have found the new carrying costs of a secondary property are higher than they expected when they initially purchased.

Regulations such as short-term rentals have seen a very limited impact on Lambton Shores Municipality, where Grand Bend is located, due to a strong policy in place that protects homeowners while still allowing for rentals with limited regulations. However, Bluewater Municipality (north of Grand Bend), has more regulations in their short-term rental bylaw, limiting the number of rentals in an area and making new rental permits difficult to obtain.

Advice for Buyers

- For Buyers, there is lots of inventory to find what they are looking for and typically room to negotiate, as well as conditions to ensure their protection.

- For Sellers, pricing is a key consideration. Location or benefits are also more important in this market in terms of pricing.

KENORA & LAKE-OF-THE-WOODS, ON

Kenora and Lake-of-the-Woods is expected to see a competitive recreational market in 2024, leaning more in favour of a seller’s market. There are many buyers from Manitoba and other areas who are looking for a summer cottage in the area. Currently, there is low inventory for recreational properties, but that will likely change in May, when the ice is off of the lakes.

The average sale price decreased by seven per cent year-over-year (from $389,066 in Q1 2023 to $361,852 in Q1 2024). The number of sales decreased in lockstep, falling 8 per cent year-over-year (from 19 in 2023 Q1 to 16 in 2024 Q1).

Looking ahead, average sale prices are likely to increase by five per cent by the end of 2024, and the number of sales will likely increase by 15 per cent.

LAKE HURON AREA (BAYFIELD & GODERICH), ON

The Lake Huron recreational property market is experiencing balanced conditions due to fewer buyers in the market and more listings. Families, couples (including young and middle-aged) and retirees are currently driving recreational property sales in the region – a trend that is expected to continue in 2024.

Average recreational sale price across all property types, including residential and recreational, decreased by 7.9 per cent year-over-year (from $730,507 in Q1 2023 to $672,690 in Q1 2024). The number of sales decreased by 14 per cent year-over-year (from 35 in 2023 Q1 to 30 in 2024 Q1).

Looking ahead, average sale prices are likely to decrease by five per cent by the end of 2024, while the number of sales is expected to decrease by 10 per cent.

Buying & Selling in Lake Huron

Recreational properties are available in the region, but buyers seem to be holding off purchasing. Lakefront cottage sales are slow compared to other years, with fewer buyer inquiries for recreational properties trickling in. Interest rates have had a negative impact on the market in general, with buyers hesitant to pay the higher cost of borrowing for a recreational property.

Buyers are typically coming from Kitchener, London and Toronto – a trend consistent year-over-year. The features and amenities in greatest demand in 2024 include:

- Waterfront properties

- Good Wi-Fi access

- Access to recreational activities

Regulations such as short-term rentals are impacting the local residential market in a negative way. Buyers and investors are reluctant to purchase at this time. Also, short-term rental laws will decrease recreational values.

Since COVID-19, sellers are still hoping to get COVID prices, but the buyers are not competing which keeps the sales prices lower. Interest rates have a negative impact on the market.

Advice for Buyers

- Buyers have the luxury of being patient with their purchase, with fewer competing bids.

- Buyers can insert conditions into their offers.

- Great time for buyers to consider purchasing.

The post Ontario Cottages Could See Price Gains in 72% of Markets appeared first on RE/MAX Canada.

Categories

Recent Posts

GET MORE INFORMATION