62074 TWP Rd 730 Rural Grande Prairie No. 1 County Of, AB T0H 3V0

UPDATED:

11/14/2024 05:45 PM

Key Details

Property Type Vacant Land

Sub Type Commercial Land

Listing Status Active

Purchase Type For Sale

MLS® Listing ID A2179203

Originating Board Grande Prairie

Tax Year 2024

Lot Size 10.000 Acres

Acres 10.0

Property Description

Location

Province AB

County Grande Prairie No. 1, County Of

Zoning RM2

Interior

Inclusions NA

Exterior

Fence None

Others

Restrictions None Known

Tax ID 94269043

Ownership See Remarks

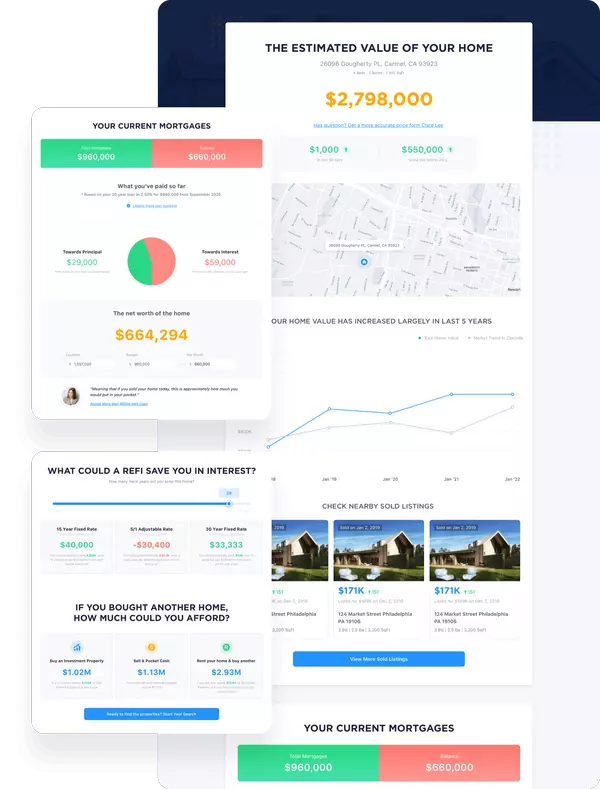

MORTGAGE CALCULATOR

By registering you agree to our Terms of Service & Privacy Policy. Consent is not a condition of buying a property, goods, or services.

Go tour this home

62074 TWP Rd 730

- Any

- $ 100,000

- $ 150,000

- $ 200,000

- $ 400,000

- $ 800,000

- Any

- $ 100,000

- $ 150,000

- $ 200,000

- $ 400,000

- $ 800,000

MARKET SNAPSHOT

(NOV 11, 2024 - DEC 11, 2024)

MARKET SNAPSHOT

By registering you agree to our Terms of Service & Privacy Policy. Consent is not a condition of buying a property, goods, or services.

Why Choose Us

Free & Instant Home Valuation

Estimate how much you can get by selling your home and keep track as the market changes.

Sell Faster

Our team utilizes the power of online marketing to sell faster than an average real estate agent.

Save Money

Our experts help you sell for the highest price point possible.

MY BLOGS

Your Guide to Cottages for Sale in Nova Scotia

Nova Scotia’s southern coast is renowned for its stunning natural beauty. From the iconic lighthouse at Peggy’s Cove to the historic Bluenose II and pristine oceanfront beaches, the area offers breathtaking landscapes that are perfect for relaxation and outdoor activities. Imagine waking up to the sound of the ocean and spending your days exploring picturesque coastal trails. With beautiful oceanfront beaches and plenty of fresh seafood, it’s no wonder people are flocking here. In recent years, there’s been a noticeable trend of rising property prices, particularly for inland cottages. Many buyers from provinces like Ontario and British Columbia are seeking better real estate deals and have set their sights on this coastal haven. As more people discover the charm and affordability of Nova Scotia, the vacation property market is booming, making it a great time to consider buying your own piece of this coastal gem.Property TypesWaterfront vs. InlandWhen looking for cottages for sale in Nova Scotia, deciding between a waterfront and an inland cottage is a significant consideration. Waterfront properties offer direct access to the ocean, incredible views, and the quintessential coastal experience. These properties often come at a premium but are highly sought after for their unique location and scenic vistas. On the other hand, inland cottages can be more affordable while still providing easy access to the coast. These properties often come with more land, offering greater privacy and opportunities for gardening or outdoor recreation.Size and LayoutIf you are considering cottages for sale in Nova Scotia, assess the size and layout of the cottage. Smaller cottages might be easier to maintain and cost less to heat and cool, making them ideal for cozy getaways. However, larger properties can accommodate more guests, offer more space for activities, and are perfect for hosting family gatherings or entertaining friends. Open floor plans with combined kitchen and living areas can create a welcoming, communal space, while separate bedrooms and bathrooms provide privacy. Outdoor spaces like decks, patios, and yards are also important for maximizing your enjoyment of the cottage.New vs. OldCottages for sale in Nova Scotia can have newly built cottages offering modern amenities, energy efficiency, and fewer immediate maintenance concerns. However, older cottages often come with charm, character, and unique architectural details. Weigh the pros and cons of each to determine which suits your lifestyle and preferences.Market TrendsInvestment PotentialCottages for sale in Nova Scotia, particularly on the South Shore, have seen a surge in demand. Recent trends show rising property prices driven by buyers looking for more affordable property options. This highlights the investment potential of buying cottages for sale in Nova Scotia. As more people discover the region’s charm, property values are likely to continue rising, making it a wise investment. Other popular areas include the Annapolis Valley, with its beautiful landscapes and vineyards, and Cape Breton Island, known for its stunning coastlines and vibrant cultural scene. The Eastern Shore is also gaining attention for its secluded beaches and tranquil environment.Rental IncomeIf you’re considering renting out your cottage when you’re not using it, Nova Scotia offers excellent rental income opportunities. High demand for vacation rentals can provide a steady income stream and help offset the costs of ownership. For instance, rental rates for cottages in popular areas like the Annapolis Valley and the South Shore can range from $1,000 to $3,000 per week during peak seasons, depending on the property’s location and amenities. Cottages for sale in Nova Scotia with desirable features such as proximity to beaches, scenic views, and modern conveniences tend to have higher rental potential.Year-Round AccessibilitySeasonal ConsiderationsWhen purchasing cottages for sale in Nova Scotia, consider the year-round accessibility. Some properties may be in remote areas that are difficult to access during the winter months. Ensure that the local municipality or private contractors maintain the access roads to the cottage throughout the year. It’s also wise to verify the availability of essential services like grocery stores and medical facilities nearby, which can be crucial during winter. Easy access enhances the usability and value of your cottage as a versatile retreat for all seasons.WinterizationIf you plan to use your cottage during the colder months, assess if it is properly winterized. Check if it has adequate insulation in the walls, roof, and floors to retain heat. Verify that the heating systems, such as furnaces or space heaters, are in good working condition and have been serviced recently. Inspect the plumbing to ensure pipes are insulated or have heat tape to prevent freezing, and look into drafts around windows and doors that could let in cold air. It’s also beneficial to have a backup power source, like a generator, in case of winter power outages. Hiring a professional home inspector who specializes in winterizing properties can provide a thorough evaluation to ensure your cottage is ready for winter.Flood and Storm RiskCoastal properties might be at risk of flooding or storm damage. When looking for cottages for sale in Nova Scotia, understand the local risks and take necessary precautions, such as proper drainage systems and sturdy construction to withstand extreme weather conditions.Property Condition and MaintenanceRenovations and UpkeepNova Scotia’s maritime climate can be tough on buildings, so it’s important to assess the condition of the property and any necessary renovations or maintenance. The positive side is that many local contractors are experienced in maintaining and renovating cottages to withstand the coastal weather. Investing in a property that requires a bit of TLC can also be an opportunity to customize it to your taste and increase its value.LandscapingIf you plan to purchase cottages for sale in Nova Scotia, think about landscaping. Coastal areas may require specific plants that can withstand saltwater exposure and high winds. Maintaining the grounds can enhance the beauty of your cottage and create a pleasant outdoor space.Buying cottages for sale in Nova Scotia means embracing the beauty of nature while capitalizing on significant investment potential. Small towns and villages along the coast offer a welcoming atmosphere, with friendly locals and a variety of amenities. Proximity to healthcare facilities, grocery stores, and recreational activities enhances the quality of life and makes owning a cottage even more enjoyable.At RE/MAX, our agents have exceptional local knowledge and expertise, providing personalized advice and service to help you navigate the unique real estate market of Nova Scotia. We can help you find cottages for sale in Nova Scotia so you make your dream of owning a cottage a reality.Find a RE/MAX AgentThe post Your Guide to Cottages for Sale in Nova Scotia appeared first on RE/MAX Canada.

What is a VTB?

Getting approved for a mortgage can be tough. Lenders dig into every aspect of your financial life, from your credit history to your job and debt levels. With rising real estate prices in cities like Toronto and Vancouver and higher interest rates, securing a traditional mortgage has become even more challenging. If you’ve recently been through bankruptcy, have no down payment, or have a poor credit history, traditional lenders might reject your application. The Canadian mortgage stress test has also made it more difficult for many potential buyers to qualify for traditional loans, adding another layer of complexity. This can feel overwhelming and discouraging, especially when you’re eager to secure a home.In these situations, a VTB or vendor take back mortgage could be a great alternative. What is a VTB mortgage? This type of mortgage allows you to bypass some of the rigid requirements of traditional lenders. Instead of dealing with a bank, you negotiate directly with the seller, who may be more willing to work with your unique financial situation. We answer your burning questions like what is a VTB in real estate and how it can provide you with an opportunity to purchase a home that might otherwise seem out of reach.What is a VTB Mortgage and How Does It Work?If you can’t pay the full price for a home, you usually get a traditional mortgage. You use your savings and maybe equity from selling another home as a down payment, then apply for a mortgage through a bank for the rest. The lender checks your credit and finances. If you’re approved, you make an offer. Once accepted, the sale closes, the seller gets paid, and you owe the bank the loan amount plus interest. After that, your main dealings are with the bank.You may be wondering what a vendor take-back (VTB) mortgage is in real estate and why it’s becoming more popular. A VTB mortgage is different from a traditional one. Instead of getting a loan from a bank, you find a seller willing to act as the lender. This usually means the seller doesn’t have a mortgage on the property. You and the seller agree on the mortgage terms, including the down payment and interest rate, which is often higher than what banks offer. You make payments directly to the seller over the loan’s term, with the property as collateral. Unlike traditional mortgages, this setup creates an ongoing relationship between you and the seller, involving regular payments and potential further interactions if any issues arise.What is a VTB in Real Estate, and What are the Benefits?A VTB in real estate is a type of financing where the seller of a property also acts as the lender. This is especially helpful for buyers with poor credit, as it provides an alternative to traditional bank loans. There are various benefits to VTB financing for buyers and sellers alike.Flexibility in Mortgage TermsWith VTB mortgages, the terms are more flexible than with traditional bank loans. Buyers and sellers can negotiate terms that fit their needs, like the down payment, interest rate, and repayment schedule. This accommodates unique financial situations, making the home-buying process smoother. For example, a seller might accept a lower down payment in exchange for a higher interest rate or adjust the repayment terms to suit the buyer’s income pattern.Steady Cash Flow for SellersVTB mortgages provide sellers with a consistent income stream over the loan’s term instead of a one-time payment. A VTB provides a consistent and predictable income stream, particularly useful for retirees or those who need regular income for living expenses and long-term financial stability.Potential Tax Benefits for SellersSellers can also benefit from offering a VTB mortgage, particularly with tax savings. By receiving payments over time instead of a lump sum, sellers can spread their income across several years, potentially lowering their immediate tax burden. This steady income stream can help sellers manage their finances better and keep them in a lower tax bracket. Of course, professional advice is always recommended when it comes to taxes.Easier and Faster TransactionsSince VTB mortgages bypass many of the bureaucratic hurdles associated with traditional bank loans, they can lead to quicker and smoother transactions. Without needing bank approval, buyers and sellers can close deals faster. A buyer struggling to meet a bank’s requirements might secure a property more quickly through a VTB arrangement, benefiting both the buyer and the seller.Access to Larger MortgagesSometimes, VTB mortgages allow buyers to get larger mortgages than they might qualify for with traditional lenders. By negotiating directly with the seller, buyers can secure financing that better suits their needs, enabling them to purchase their desired property. A buyer might afford a larger home or a property in a more desirable location through a VTB mortgage than with a bank loan.Customizable Repayment SchedulesAnother benefit of VTB mortgages is the ability to customize repayment schedules. Buyers and sellers can agree on a plan that fits the buyer’s financial situation, like interest-only payments for a while or adjusting payments based on seasonal income. Customization makes it easier for buyers to manage their finances and stay on top of their mortgage, reducing the risk of default. Take a buyer with a seasonal business; they might be able to negotiate lower payments during the off-season and higher payments during peak times.Involving a real estate agent in a VTB mortgage brings numerous benefits for both buyers and sellers. If you’re looking for a home with a VTB mortgage or considering offering one for sale, trust RE/MAX for the support you need.Find a RE/MAX AgentThe post What is a VTB? appeared first on RE/MAX Canada.

Why Is Toronto so Expensive?

How much does it cost to live in Toronto? If you wish to live in the heart of North America’s fourth-largest city, you should be aware that the average price for a home in the Toronto real estate market was $1,114,267 (January 1-October 31, 2024). Put simply, it takes plenty of capital to live in Toronto.Now, by comparison, the national average home price sat just below $700,000 in October 2024, the Canadian Real Estate Association (CREA) notes. Even on the rental side of the Toronto housing market, the typical one-bedroom apartment is more than $2,400, based on a long-running monthly report. Evidently, housing costs and the overall cost of living in Toronto are much higher than in other municipalities, be it major urban centres or suburban towns. So, why is Toronto so expensive anyway?Let’s sift through some of the reasons why Toronto is expensive.Why Is Toronto so Expensive?According to data from Numbeo, the estimated monthly cost for a family of four is around $5,550 (without rent). For a single individual, the approximate monthly expenses are north of $1,500 (again, without rent).How does this compare with a city like, let’s say, Vancouver? In other words, is Vancouver more expensive than Toronto? Surprisingly, Numbeo statistics suggest that the cost of living, including rent, is a little more than five per cent lower than in Vancouver. Additionally, the data suggest that Toronto is the most expensive city in Canada, followed by Vancouver, Montreal, Ottawa, and Calgary. It is also the 90th most expensive city in the world.Of course, housing is the primary issue for many Torontonians. Everything from monthly mortgage costs to property tax rates to home insurance, buying a home in Toronto is a costly endeavour. While condominiums are priced lower than detached, semi-detached, or townhomes, the maintenance fees associated with condo living can be quite expensive.Why are Houses in Toronto so Expensive?It is a case of supply and demand.Toronto is the most populated city in Canada, and many newcomers are planting roots in Toronto. So, there is increased competition for limited supply for a city that suffered lacklustre housing inventories. Plus, the figures highlight that common things like garbage pickup and electricity can be quite elevated in Toronto.Unfortunately, the gap between household incomes and monthly living expenses (housing, utilities, groceries, and transportation) is widening, too. It is important to note that while the city is becoming more and more expensive to live in, the median income for people in Toronto has not witnessed comparable income gains. In 1990, the real (inflation-adjusted) median income for a prime working-age (25 to 54) individual in Toronto was about $54,000. Today, based on 2021 Census data, incomes have been relatively unchanged after reflecting inflation trends.Put simply, the cost of living has long surpassed any sizeable increase in median income.As The Toronto Star reported in October 2023: “While the average income for individuals in the Toronto area has increased since the 1990s, the median income is the same, according to census data, adjusted to inflation, suggesting pay has remained stagnant for the lowest earners, but increased somewhat for higher earners.”Even parking and traffic have metastasized into substantial problems in Toronto. This is why many individuals choose not to use an automobile and avoid the high expenses of car payments, auto insurance, and parking. At the same time, the costs can still be quite high for those who select public transportation as their primary mode of transportation, as a one-month transit pass in Toronto costs $156. This is one of the most expensive transit passes in North America.Toronto is Canada’s economic powerhouse. It is home to the five largest banks, major law firms, and large corporations. The Toronto Stock Exchange is the seventh largest in the world in terms of market capitalization. All these factors directly impact the cost of living in this city.Toronto Is Still a Great CityThe challenges gripping Toronto are happening in big cities nationwide. For years, many municipalities have possessed strict zoning regulations that limit the availability of land for development. The influx of new immigrants in Canada, record low mortgage rates, and changing consumer trends have all been factors that have influenced housing markets everywhere.Is it only a matter of trying to answer the age-old question of “Why is Toronto so expensive?” Or has the conversation evolved into “Why is Canada so expensive?”In the end, Toronto maintains a vibrant cultural hub in Canada. Despite its growing list of issues, Toronto continues to be an attractive destination for immigrants, single individuals, young couples, and families. Yes, homeownership is expensive, and rents continue to increase at a high pace, but what other Canadian city is not enduring these same developments?Find a RE/MAX AgentThe post Why Is Toronto so Expensive? appeared first on RE/MAX Canada.

REVIEWS

- I met with the realtor Ahmed Arshad through Houseful online agency. He was very polite gentleman who knows his job and in very professional manner he sold our house in three days for very good price. Later he guided us to buy a new house. And he showed us how to be careful about some missing, or bad things in the houses we looked at. It was a very exciting adventure working with Mr Ahmed Arshad and for very short time we found and bought the house were now we live in. Thankful Kiro and LidijaKiro Seremetkoski

- Definitely will recommend to those who is looking for their new home.Jeric Salazar

- Erica Salazar

Our Team

1301 8th Street SW, Calgary, AB, Canada